Atkore

The Business

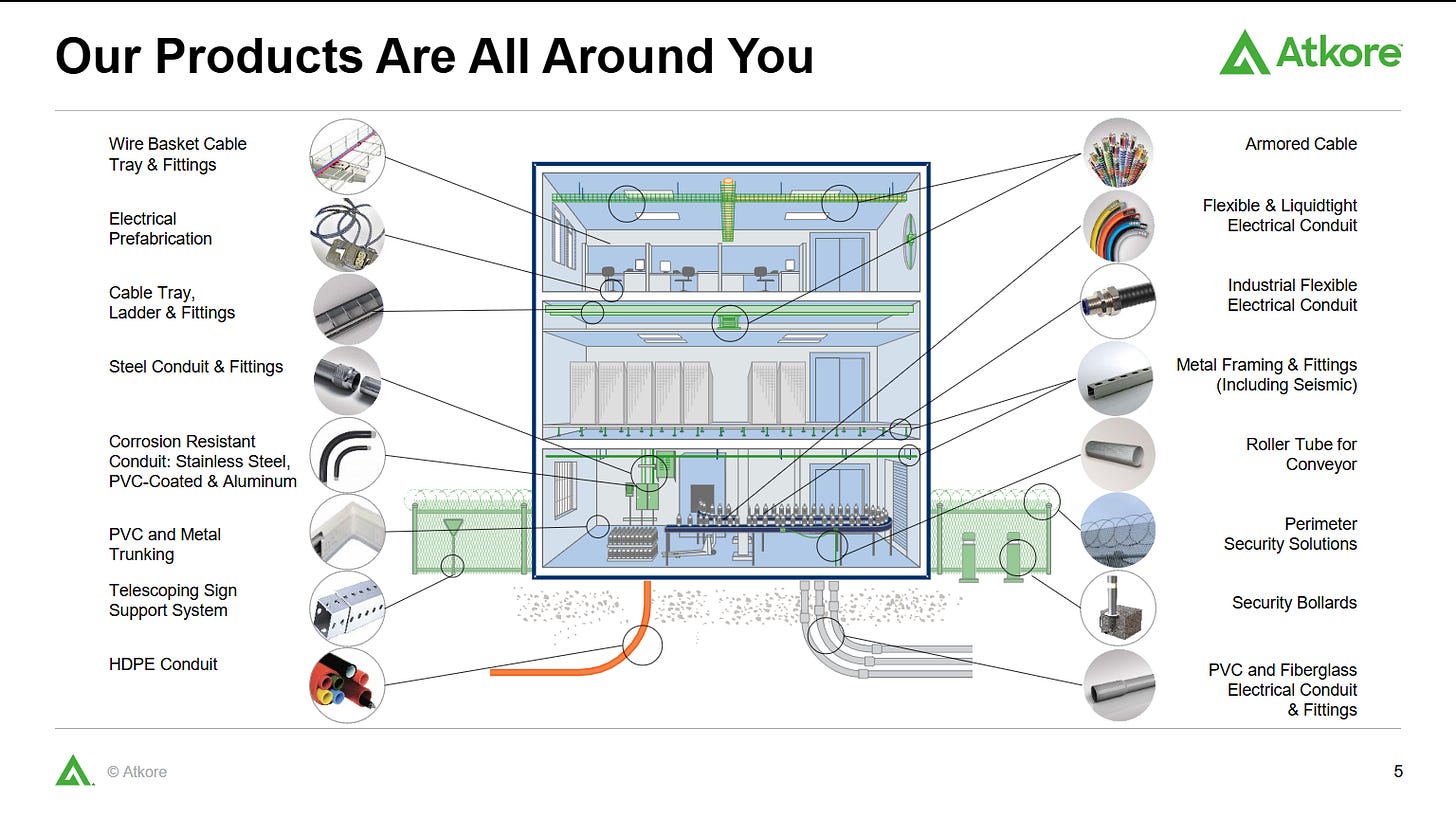

Atkore is a manufacturer that specializes in electrical, safety and infrastructure products. 90% of what they sell falls into the electrical infrastructure category.

They manufacture things like:

Electrical conduit and fittings

Cable and cable management systems

Metal framing

Safety and security products like fencing and security bollards.

They have a great slide it their investor presentation that shows where their products might be found:

The Moat

From the 10-K:

"We believe we hold #1 or #2 positions in the United States by net sales in the vast majority of our products. The quality of our products, strength of our brands, our scale and national presence provide what we believe to be a unique set of competitive advantages that position us for profitable growth."

Atkore has scale advantages, meaning they’re likely a low-cost producer.

More importantly, their huge nationwide network allows them to deliver whatever is needed, wherever it’s needed, on time.

That’s a big deal when you’re building a new data center or hotel. Because conduit, cable support trays, and sign supports are such a small percentage of the total cost to construct a building, contractors are willing to pay a little bit more from Atkore to guarantee they’ll have their parts on time. This is what sets Atkore apart from competitors. They talk about “one order, one delivery, one invoice.”

The Market

As I said, 90% of what Atkore sells falls into the electrical infrastructure category. If you’re paying attention to current trends, this is a good thing. As the world moves towards cleaner energy, we’re using more electricity. AI and cloud computing are demanding data centers. Extreme weather is causing certain regions to harden their electrical grids. Atkore appears to have strong secular tailwinds behind them.

Finances

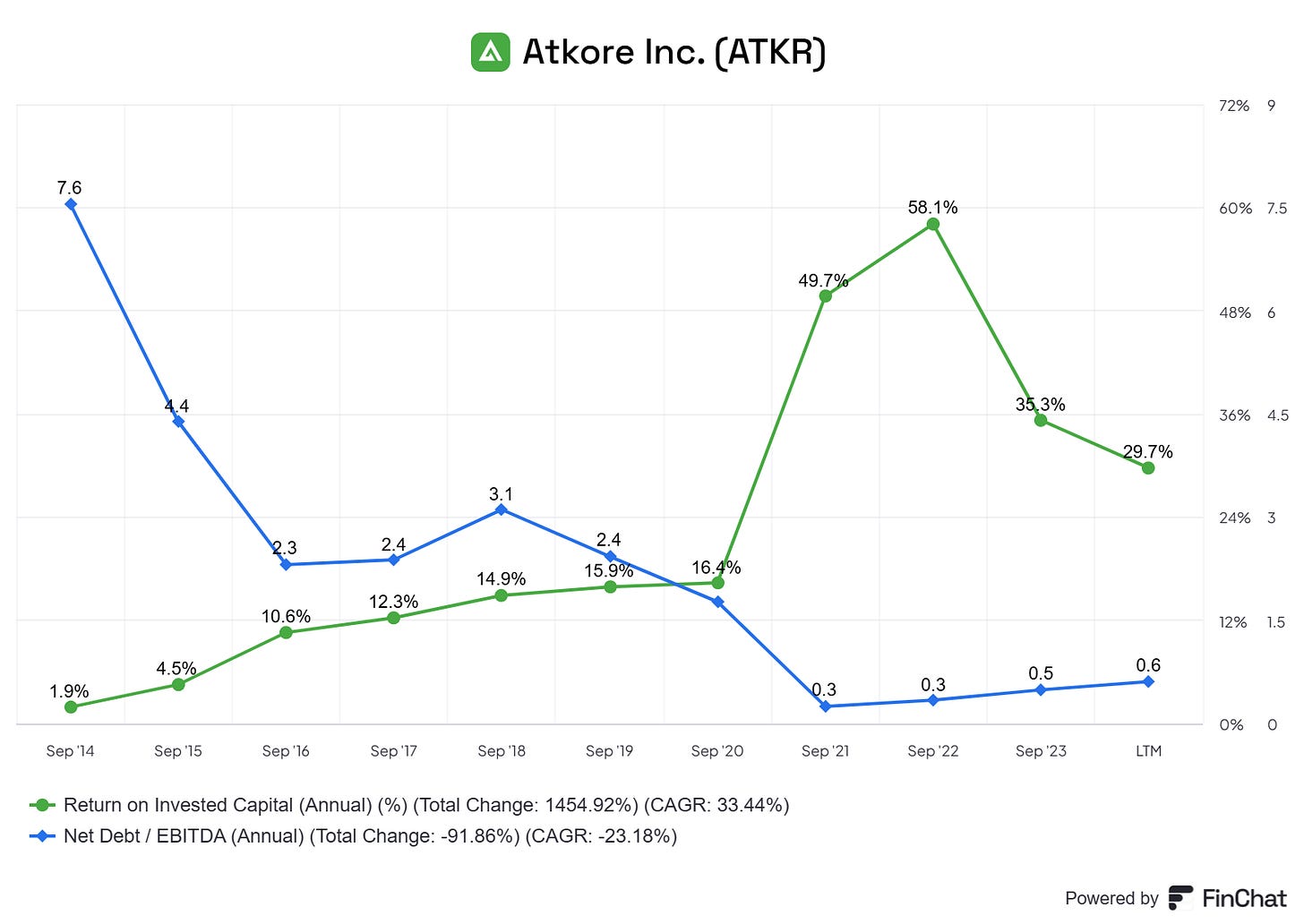

Atkore has grown impressively in the past.

Management looks to have done a good job, with ROIC increasing and debt levels decreasing:

They’re also buying back lots of shares:

Looks good so far! Sounds really good when I tell you that Atkore trades at a PE of less than 9.

Valuation

This is where things start to fall apart on my Atkore case. They’ve seen massive jumps in revenue and earnings since COVID. They’ve also seen massive margin expansion.

So, to value Atkore, we have to know that these new, higher margins are sustainable.

Here’s David Johnson, Atkore’s CFO discussing some of these jumps:

So, we during the COVID period of time experienced a really robust market for one of our product lines. It's called PVC conduit, which was used in which is used in single family housing when you're building out a big neighborhood and all those sort things.

So going into COVID, markets were pretty strong and then we had a pretty significant disruption in supply of resin, which in turn led to some very large pricing gains for us and for our competitors. So in this timeframe, we went up from like $400,000,000 of EBITDA to like $1,300,000,000 of EBITDA during this period of time. I'm giving you a little bit of history because I think it is pertinent to today's kind of mindset in our investor base. During that whole ramp up, we always articulated that this would not be permanent. We would not be making $1,300,000,000 forever, that there is a certain amount that we would call as over earned that would normalize over a period of time.

And we peg that number at $585,000,000 So it sounds pretty exact, but getting there probably wasn't as exact. And we said it would be a multi year experience. Probably not a pleasant one because you're going to see declining EBITDA over multiple periods of years. There's nothing that's going to happen really quick. And we always said the longer the better because we'd be making generate a lot more cash, we'd be deploying it, I think, in appropriate places.

Management says margins expanded due to price increases, and the PPI data agrees.

Based on the graph, we can see that prices look like they’ve started to stabilize some, but they’re still way above 2020’s prices. Where will prices ultimately end up?

I have no idea. Is the new conduit price going to be the 2024 price? Will they fall all the way back down to 2020 prices? Will prices stabilize somewhere in between?

I should probably throw Atkore into the ‘too hard’ box right now and move on.

But…

Given the market, moat, balance sheet, and buybacks, I’m tempted to dig further.

Fortunately, management is being pretty straightforward about what’s going on (it seems). They say that they’ve structurally improved their business since 2017 and provide guidance on what they think their long-term EBITDA margin is.

They’re also not projecting massive amounts of growth into the future:

Even without margins falling, low growth makes sense. A few points:

In the period before 2021, Atkore did not grow revenue rapidly.

Despite the secular tailwinds behind them, actual sales of product will likely be constrained by the construction labor force. The same workers will be building data centers, installing renewable energy, and hardening grids across the country. They can’t do it all at once.

Is management being realistic?

Normalizing 2023

Let’s start by normalizing last year’s performance. Atkore’s adjusted EBITDA and reported EBITDA are very close. So, being conservative and using management’s long-term EBITDA margin of 25%, we get to a normalized EBITDA of about $880 million.

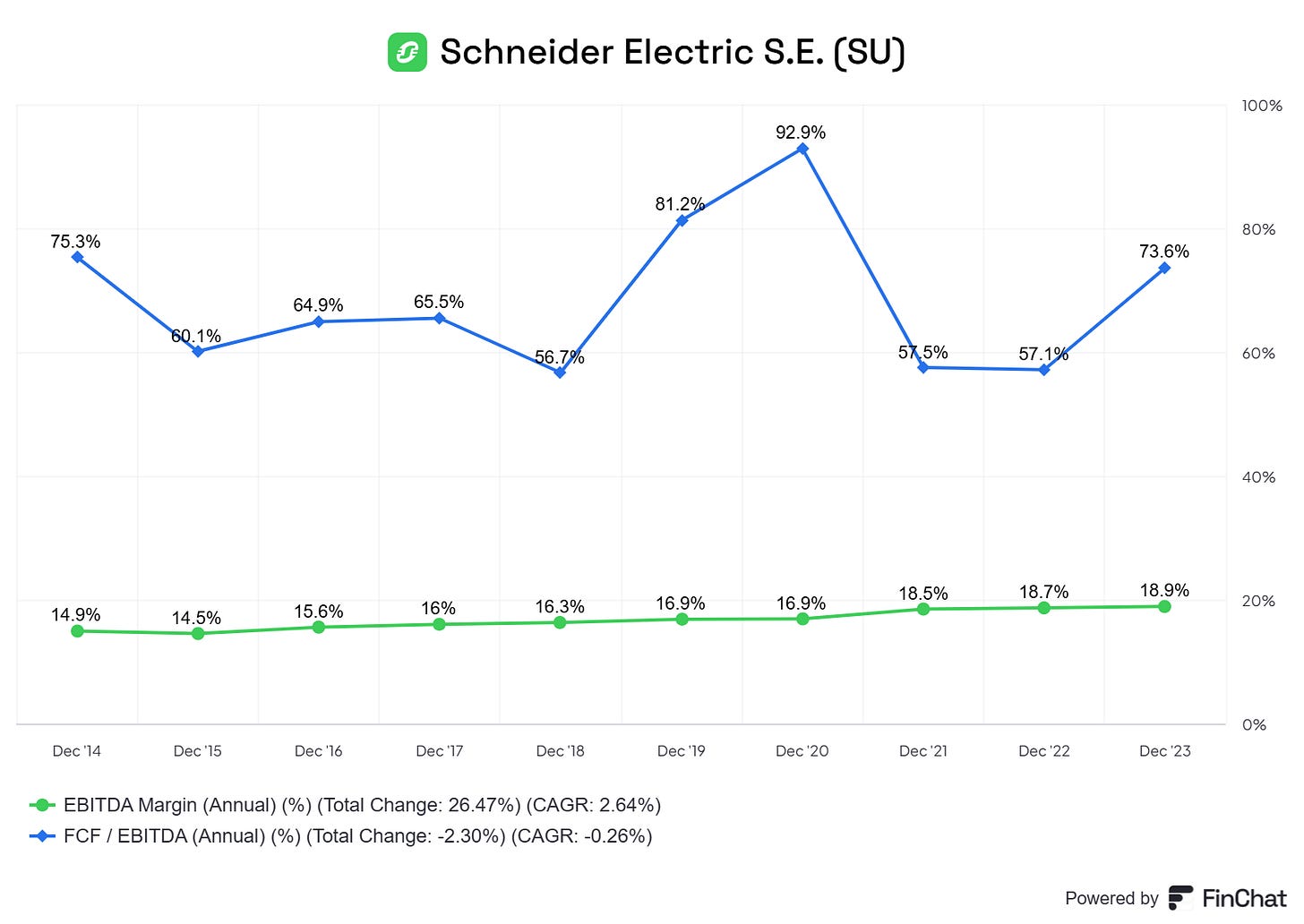

While EBITDA isn’t one of my favorite metrics, it’s what management gave us. But, we can look at the history of the company and see that about 50% of EBITDA turns into FCF - a more useful number. So, we can estimate a normalized FCF of $440 million.

How’s that compare to competitors?

Eaton is huge, and makes more than electronics, but they’re a reasonable place to start. The EBITDA margin is a bit lower than 25%, but FCF conversion is around 50%.

Legrand is a French manufacturer that is also pretty comparable to Atkore. Legrand also makes switches, outlets and control systems. They also have lower EBITDA margins, but better FCF conversion than Atkore.

Schneider is again more diversified than Atkore, but again, we see lower EBITDA margins, but better FCF conversion.

The nice part about these businesses is that COVID did not change their EBITDA margins.

Our normalized 2024 numbers may be close to reasonable.

Working with $440 million in FCF, we can now calculate that the company trades at a FCF yield of about 7.5%. Not bad.

Reverse DCF

Using the normalized FCF of about $440 million, we can also run a reverse DCF to see what the company needs to do to give us a desired return. For a 15% return, Atkore has to grow FCF by 9.5% per year.

This is pretty optimistic, given management’s near-term projections. It’s also likely optimistic given that the cable tray and conduit markets are expected to grow somewhere between 4% and 12%.

Cable Tray Market Growth, Growth Estimate #2

Shareholder Yield

We can also look at shareholder yield to get an idea of what kind of return Atkore might provide, given the buyback history. However, to have really good returns from buybacks, we need:

Stable or growing earnings for a long time

Buybacks at a fast pace

A cheap multiple

Let’s check on #1:

Not as stable as I’d like to see.

Using the consensus estimates and management’s long-term EBITDA margins, we can figure out that over the next 3 years, Atkore will likely earn about $1.3 billion in FCF.

Used for buybacks, that would give us about a 25% yield in buybacks. Add in 3% for dividends and you get 28% over the next 3 years, or about 8.3% per year.

These revenue levels also depend on the margins not falling too quickly.

What about #2? Buybacks at a fast pace?

Here’s management on M&A:

We've always been pretty robust, active in the M & A market. I mean, our PVC business basically was built out of consolidating a bunch of acquisitions during the CB and R time. So, we have some history of being able to do that.

Maybe not.

Atkore has seen excess capital flow in because of the elevated margins, and management has wisely used it for share buybacks. It’s not clear that if the margins fall that management will continue buying back shares at the same rate.

How about #3? A cheap multiple?

If conduit prices stabilize at current levels, then yes.

What about if they end up somewhere between current levels and 2020 prices?

It’s a quick guess, but if we divide 2024 EPS by 1.5 to adjust for conduit prices falling halfway between current prices and 2020 we get about $11.50. If we assume they grow 6% a year from there, put a 12x multiple on it and use a 10% discount rate, we get a fair value of about $95 a share.

Again, maybe not.

Is management buying?

One more attempt to rescue this from the ‘too hard’ pile. Does management think the stock is cheap?

No.

Insiders haven’t bought one share in the past year. In fact, they haven’t bought a share in two years.

Bringing it all together:

Atkore makes necessary products, with secular tailwinds behind them.

Despite this, growth will likely be slow due to limited labor and long backlogs in the construction industry.

Atkore has scale and distribution advantages compared to competitors.

They have a solid balance sheet, and management has allocated capital well in the past.

Atkore saw huge jumps in margins and profitability after the COVID pandemic due to tight supply. It’s not clear that these elevated margins will be sustainable.

Because of the distortion in margins, valuation of the company is too hard.

The lack of insider buying confirms that Atkore may not be as undervalued as it first appeared.

At this point, Atkore is not a no-brainer for me. I don’t have concerns over the business, so if the market would over-react to an earnings report, margins falling or some other event, I would consider re-visiting it.

Great work! You have a real skill for clear and concise analysis. Any thoughts why Atkore sales, and volume in particular would not grow in line with Eaton? I assume their products are sold in conjunction and have similar demand?

Sorry, another short attack shout. Any thoughts on price fixing? Is this true and if yes, does it show unethical management or just opportunistic? https://manbearchicken.substack.com/p/pipe-price-fixing?utm_source=substack&utm_medium=email