When we last talked to Chuck during the banking crisis in March, the questions we asked centered around if the banking panic would spread, and if Charles Schwab would see bank runs like Silicon Valley Bank and First Republic.

I concluded that based on the fact that most assets held at Schwab were either locked up in retirement accounts, or intended for investment, that they would not see the kind of runs that occurred at the banks that failed. I also concluded that even if they did see significant withdrawals that they had adequate liquidity to survive.

I had, what I felt to be a sufficient understanding of the business to follow the insiders into a position at a cheap price, which was based on a short-term panic. Since then, I’ve done much more research, have a much better understanding of the business, and through the TD Ameritrade merger, have become a client as well. So it’s probably time to do an update on my thoughts on the company.

The Business

I’ve come to understand Schwab as not one business, but two. The first is the low-cost brokerage and financial advisory business that clients see. The second is the banking business.

The Brokerage

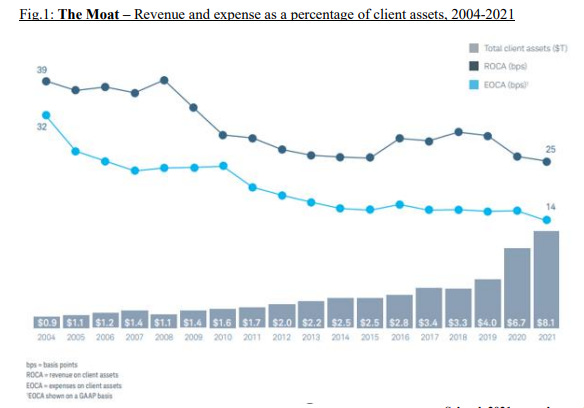

Let’s start with the brokerage side. Schwab has been lowering costs and becoming more efficient for years. This isn’t uncommon in any business. The unique thing Schwab has done, however is passed along almost all of those cost savings to customers. Schwab has maintained a relatively stable relationship between their costs related to customer assets and the revenue they generate on them:

Holland Advisors has done a wonderful update on Schwab’s business and prospects moving forward. That’s where this chart came from, and I recommend you go and read everything they’ve put out on Schwab.

This business model of passing along almost all of the savings to customers looks a lot like another really strong business - Costco. Nick Sleep refers to this as scaled economy shared. This is an incredibly strong flywheel because the more you lower prices, the bigger you get. The bigger you get, the more you can lower prices, and around and around the flywheel goes.

This model leads Holland Advisors to call Schwab the “Amazon of Finance”. I don’t disagree.

The lowering of costs culminated in 2019. Interactive Brokers announced zero-commission trades for a limited set of customers. Schwab followed by announcing zero-commission trades for everyone. This caught the entire industry off guard. Share prices for all the listed brokers tumbled. Rather than compete with Schwab, TD Ameritrade decided to sell to them. I think the fact that the deal was an all-stock transaction says that the TD Ameritrade insiders felt strongly that Schwab would do well in the long run.

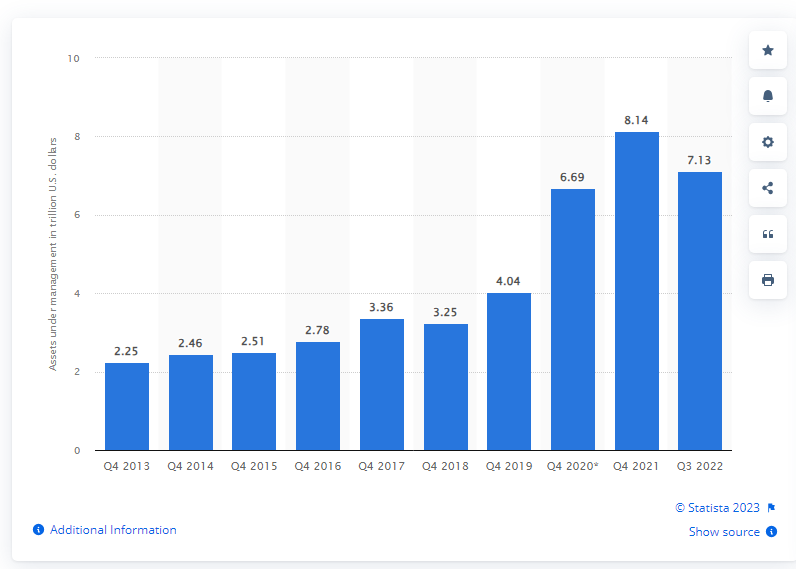

The growth of client assets held at Schwab certainly seems to confirm this. The following chart shows assets under management at Schwab in trillions of dollars:

Yes, there is a drop in 2022. The integration of TD Ameritrade clients onto the Schwab platform since the announcement of the merger has been a multi-year process. Some of the drop in assets is a result of expected attrition from the merger. Some of it is actually money moving away from Schwab, which I’ll discuss a bit later. Overall though, the trend of this graph is very clearly up.

The Bank

So we know why people invest with Schwab, now let’s look at how Schwab makes money.

Interest Revenue (From Interest Earning Assets): Charles Schwab makes more than half of its money from interest earning assets like margin loans, investment securities, and bank loans. In 2022, this was $10.6 billion

Asset Management And Administration Fees: Charles Schwab provides asset management services. They charge fees for managing client assets, such as mutual funds, exchange-traded funds (ETFs), and other investment vehicles. In 2022, Charles Schwab earned about $4.2 billion in asset management and administration fees.

Trading Revenue: Charles Schwab also makes money through trading revenue. They charge commissions on trades made through their platform. In 2022, Charles Schwab earned $3.6 billion in trading revenue.

Bank Deposit Account Fees: Charles Schwab charges fees for maintaining bank deposit accounts. In 2022, Charles Schwab earned $1.4 billion in bank deposit account fees 1.

Other Revenue: This category includes revenue from sources such as financial advice, insurance, and other miscellaneous sources. In 2022, Charles Schwab earned $782 million in other revenue

The biggest piece here is clearly the interest revenue. The way Schwab generates a lot of that revenue is by taking the cash that clients leave uninvested in their accounts and sweeping it on to the company’s balance sheet. They then invest some portion of that money into things like treasuries, mortgage-backed securities, etc. This means that this portion of the business operates as a bank. Schwab does, in fact have a banking license and it is subject to banking regulations.

This model is what let Schwab cut commissions to zero. They were not reliant on trading revenue for income. Instead, the way they grew income was by growing assets under management. It turns out that, on average, around 5% of client assets tends to sit around in cash, waiting to be invested. This is the money Schwab invests and makes interest income on.

The Current Status

In “normal” times, this seems like a pretty good model. Customers get great service for what seems like free, and Schwab grows assets under management, in turn growing revenue.

We are not, however in normal times. The Fed has raised interest rates at the fastest pace in recent history, and cash now yields anywhere between 3% and 5%.

The Worries

Because of the structure of Schwab’s banking business. There are several things that an investor must now have an opinion on. These are all interrelated and make a detailed analysis of Schwab over the next few years incredibly difficult. Perhaps impossible. The way I see it, the important factors are:

Will deposit balances continue to drop?

Will the company have to borrow more from high-interest sources like the FHLB at rates of 5% or more?

Will market movements continue to impact available for sale securities?

Will Schwab be forced to sell held to maturity securities, realizing paper losses, or will they be able to allow the losses to erode as the securities mature in the portfolio?

Cash Outflows

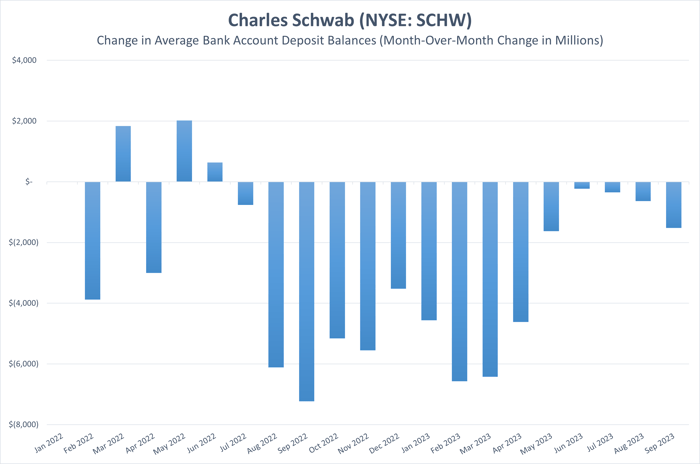

Notice that I said “seems like free” on the customer side. The way customers pay Schwab is by accepting a very low interest rate on their uninvested cash. Right now, that rate is about 0.45%. This is the other piece of the decline in client assets at Schwab. People are moving cash out of their brokerage accounts and moving it to places with higher yields - money market accounts, short-term bonds, or high-yield savings accounts. Management refers to this as “cash sorting”. This has been going on since early in 2022, but it appears to be slowing down.

Here’s a quote from Schwab’s CFO at the most recent business update:

now having closed the books on September, we have a number of tangible proof points that indicate that outflows are easing, and we’re getting closer to the return of sweep cash growth, including the fact that the overall pace of realignment activity decelerated in September to the lowest level we have seen during the current cycle.

We experienced our first month of bank sweep deposit growth since before the hiking cycle started. And both the absolute number and size of client realignment events dropped further from the level we shared last quarter.

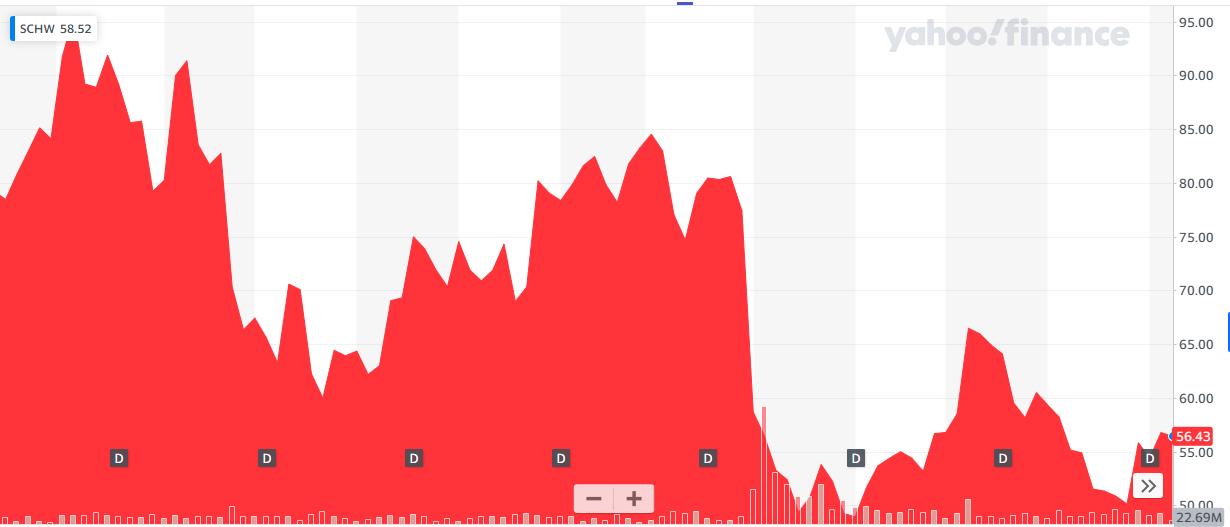

Interestingly enough, investors didn’t seem to care much about this until after March. Here’s a 2 year chart of the stock price. Notice that the price was trending up during the time this “cash sorting” was happening, and the big fall happened in March with the banking crisis.

Here are the monthly closing prices from June of 2022 from before the “cash-sorting” trend started to February 2023, before the banking crisis. The trend is up.

What’s this mean? I think a few things. First, that Schwab’s business is so complex that most investors probably don’t understand it as well as they should. Second, it could also point to the fact that investors were mostly looking at the outflows of cash as a normal and temporary trend due to the abnormal rise in interest rates. I think this is the correct view. It’s only when banks started to fail that they really worried about cash outflows and sold off the stock.

The cash outflows are trending in the right direction in the short term. In the long run, I’m confident that as interest rates stabilize and the yield curve normalizes, that Schwab’s scaled economy shared model will return client assets, and cash balance to growth.

Borrowing

In the short term, Schwab has said it will likely borrow some more funds. This is to ensure liquidity as they finalize the TD Ameritrade integration and due to some maturing debt obligations. In the long run, Schwab feels they’ll be fine. Management says the cash flow from the investment portfolio has more than covered the deposit outflows.

Management has been prioritizing repaying the 5% FHLB borrowings as a way to boost their earnings. This looks like a good use of capital to me. It’s got a guaranteed 5% return.

Again, this looks like a short-term pressure, but as a long-term investor, I think this is a temporary problem.

The Investment Portfolio

The other piece in the banking side that interest rates affect is the investment portfolio. You can read all about the portfolio in my first Schwab article. Everything there still holds true.

AFS Securities

The biggest driver in further losses in the AFS portfolio is going to be interest rates. The economy seems strong, inflation is trending in the right direction, and the FED has held rates steady the last few meetings. While the market is hard to predict, I feel pretty confident that rates aren’t going dramatically higher and the AFS portfolio has seen the vast majority of the losses that it’s going to take.

HTM Securities

There are mark-to-market losses in the held-to-maturity portfolio. Scwhab still has not had to sell any held-to-maturity securities to meet liquidity demands. At this point, it does not seem likely that they will need to.

Another worry from the HTM portfolio relates to the liquidity ratios required by the banking regulations Schwab is subject to. Right now, Schwab is in an OK position. Here’s CFO Peter Crawford:

And our capital position continues to get even stronger with our consolidated Tier 1 leverage ratio rising to 8.2%. And our adjusted Tier 1 leverage ratio, inclusive of AOCI and therefore, what our binding constraint would be if we lose the AOCI opt-out at Schwab Bank now into the mid-4% range, and that’s using average assets, it’s more like 4.6% today on a spot basis, as it steadily climbs towards 5% by the end of the year, meaning that we will be in a position to meet the newly proposed regulatory requirement organically and several years ahead of the anticipated full implementation date.

Again, this is probably a short-term pressure, but not a serious long-term concern.

The Long-Term, Broad Picture

As I said, Schwab is complex. Because of the interplay of interest rates, regulatory changes, investor psychology, and market performance necessary to forecast Schwab’s performance over the next quarters and 1 to 2 years, it’s incredibly difficult. Perhaps impossible. But this is a fabulous example of Mohnish Pabrai’s 5th commandment of investment management:

A long-term investment in Schwab at this point requires a view on 2 things:

Will Schwab continue to grow assets under management?

Will Schwab be able to generate attractive rates of return on a small portion of assets under management?

Like all investments, it also requires a view on if the business will survive in the long run.

Survivability

Stock prices frequently fall because of events. That’s what happened to Schwab in March of this year. I like to think about events in terms of both risk and uncertainty. The best events are low on risk, but high on uncertainty. At this point, I think there is a moderate amount of risk to Schwab. The investment portfolio has more duration in it than is optimal. They rely on interest income more than I’d like to see, they are increasing debt in the short term. But, most of these decisions were made before COVID, inflation, and the dramatic rise in interest rates. I’m calling these events black swans that would have been nearly impossible to see coming. Management has handled them as well as I think can be expected. I think they’re allocating capital well.

Schwab is not out of the woods, but I do think the chances of the business being destroyed are much lower now than they were earlier this year.

Asset Growth

In the short term, Schwab may continue to see outflows. However, I think the shared economy scaled flywheel is incredibly powerful. Schwab has about 12% of the wealth in the country under management currently. There is certainly room to grow that. As long as they remain client focused, I think they will. When will assets start growing again? By how much? I have no idea, but I’m not thinking in quarters. I’m thinking in quarter centuries.

Profitability

The most important thing to figure out in terms of Schwab’s profitability is the return they’ll generate on client assets. Again, most of that is interest margin, so that’s where we’ll focus. Since we’re thinking very broadly, and very long-term the question is what’s reasonable?

Management is saying around 3% for 2025. That seems reasonable to me. History backs this view up. Assuming Howard Marks is correct, and there has been a sea change, we should probably look to Schwab’s performance pre-GFC for hints as to where things may end up. Here are Schwab’s interest income margins from before the GFC:

2001

3.5%

2002

3.38%

2003

2.69%

2004

2.07%

2005

2.73%

2006

3.26%

Here they are for the past 3 years:

2020

1.62%

2021

1.45%

2022

1.78%

So in the historically low-rate environment we just went though, Schwab has been earning a lower rate. Assuming rates do not go back to near-zero, Schwab eventually benefits from the rising rates that are hurting them in the short term.

The Opportunity

Assuming you believe that Schwab will continue to grow assets under management, and will more income from them in the future, what’s the opportunity?

Again, I have no idea what’s going to happen, so let’s be conservative. Schwab has $593,772,000,000 of interest earning assets on the books as of the 2022 10-K.

If they earn 2.5% on those at some point in the future, they’ll earn $14,844,000,000 on it.

The current market cap of Schwab is $102,848,000,000. So, you’re paying about 7x Schwab’s potential interest income at some point in the future.

At 3% margins it gets even cheaper.

But wait, there’s more! That’s not the only way Schwab earns money. Let’s assume that interest income becomes even more of their revenue, say 70%. Adding another 30% to our 2.5% margins gets us to $19,297,200,000 in revenue sometime in the future. That’s 5x future revenues at today’s market cap, under pretty conservative assumptions.

I think this is the best way to think about Schwab’s valuation and potential future returns. Trying to project interest rates, borrowing levels, and bond yields over the next few quarters or years will get you a giant spreadsheet and a giant headache, but I don’t think it’ll get you very much that’s meaningful.

Now, add in some modest growth to the interest earning assets, and more return of capital to shareholders through buybacks or dividends as things normalize, and it gets very attractive.

Conclusion

The more I dig into Schwab, the more interesting it becomes. It is a shared economy scaled consumer facing business, which in the long run I expect to continue to grow.

They have combined this asset-light consumer facing business with an asset-heavy banking business. No other broker has followed Schwab’s business model. At this point, I’m not sure it’s possible to.

Schwab’s shared economy scaled model should continue to pull in assets. They should then be able to put those assets on the balance sheet and earn returns on them in the banking side of the business. I think of the banking portion much like the railroad and utility portions of Berkshire’s business. They’re all highly regulated, and require a lot of capital, but the more you pour in, the more you get out.

There are plenty of short-term risks and headwinds facing Schwab, and they’re not out of the woods. However, for an investor willing to look out decades, this could be a great opportunity.