Howard Marks is On Bubble Watch

Warren Buffett drops everything to read Marks' memos - here's what I learned in the latest one:

When Howard Marks speaks, Warren Buffett listens. Literally—Buffett says he stops whatever he's doing when one of Marks' memos lands on his desk.

Marks just released a new memo called "On Bubble Watch," and it couldn't be more timely.

With market valuations stretching higher and higher, everyone's asking the same question: Are we in a bubble?

Why Howard is Writing This Memo

Let's set the stage for why Howard is writing this memo: Today's market shows concerning signs of a possible bubble.

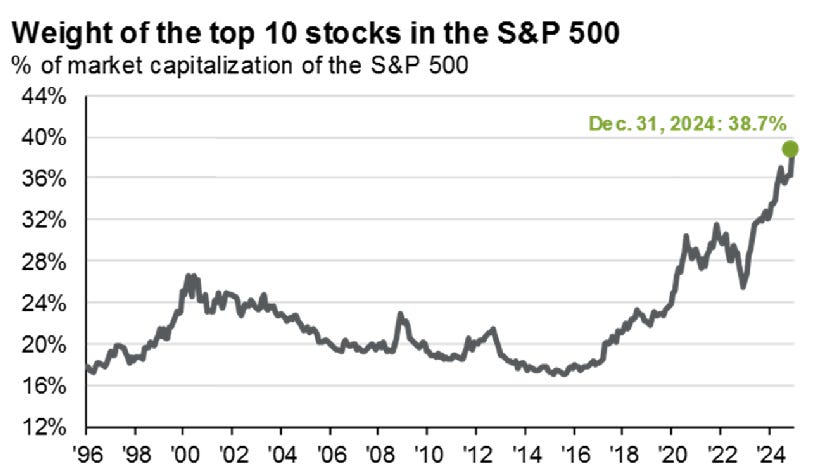

The top 10 stocks make up more than 1/3 of the S&P 500.

US Stocks make up nearly 70% of the MSCI World Index:

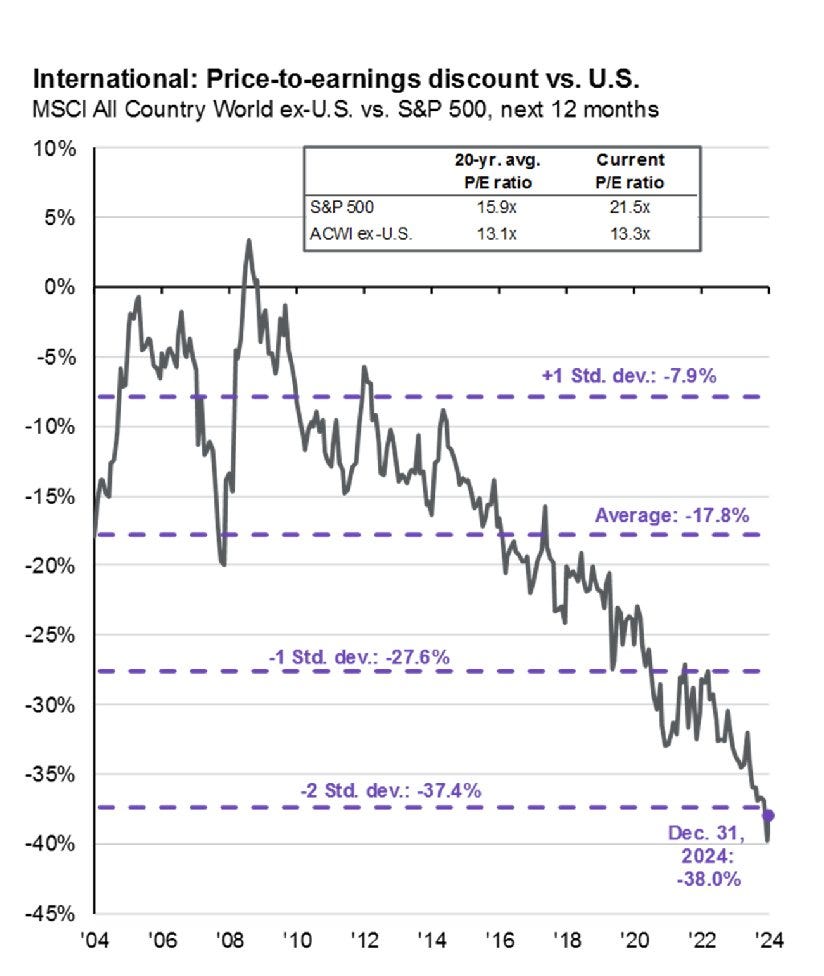

They're also 2 standard deviations more expensive relative to the rest of the world than normal:

So it's clear that investors are willing to pay a lot for US stocks versus the rest of the world.

And that investors are willing to pay a lot for the top 8 or 10 stocks in the US compared to the rest of the US market.

But is it a bubble?

The Psychology Behind Bubbles

Howard says to forget what you think you know about bubbles—they're not about rapid price increases. They're about the psychology driving those increases. Marks identifies four key warning signs:

Irrational Exuberance: When excitement about investments becomes completely detached from reality

Blind Optimism: The widespread belief that failure is impossible

FOMO Gone Wild: Fear of missing out reaches fever pitch

“No Price Too High" Mentality”: Investors convince themselves that paying any price is justified

Why "New" Is Dangerous

Innovation is a double-edged sword in investing. Here's why:

New technologies or business models lack historical precedent

Without precedent, there are no constraints on valuations

This freedom from historical anchors can lead investors astray

Even when the innovation succeeds (like the internet), investors can still lose money

We’ve seen this before.

Here’s an incomplete list of innovations that resulted in bubbles and massive losses for investors:

The first bank of the United States

Canals

Plank roads

Bicycles

Radio

Railroads

The internet

Fiber optic cables

The Price You Pay Determines Your Returns

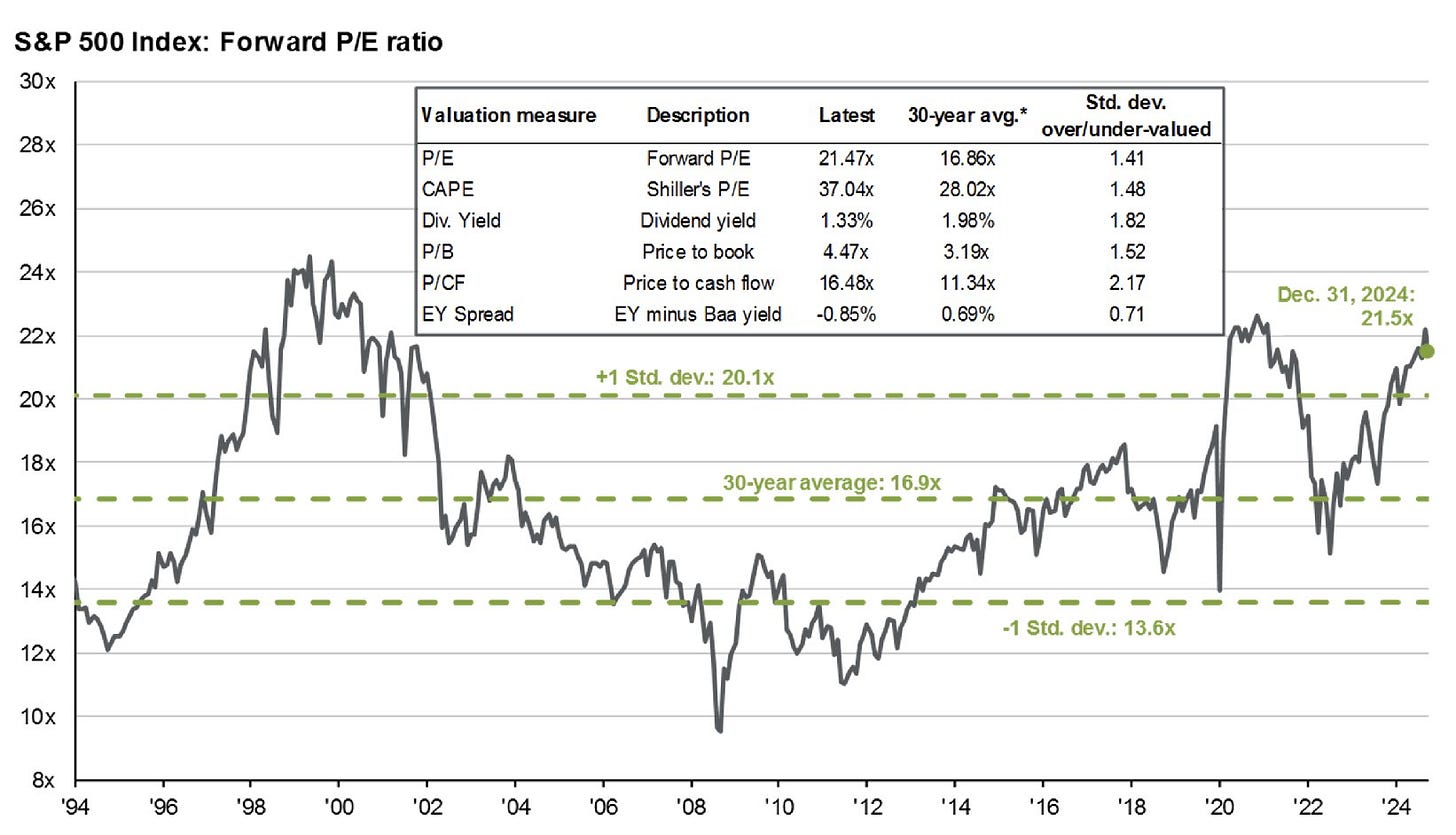

Current market valuations are flashing warning signs:

P/E ratios are in the top decile historically

Similar starting points have led to 10-year returns between +2% and -2%

Even great companies can be terrible investments at the wrong price

Remember the Nifty Fifty? Investors lost 90% on "the best companies in America"

Are We in a Bubble Now?

The evidence is mixed. Here's what we know:

Arguments for a bubble:

Market valuations are historically high

Concentration in a few mega-cap stocks

Widespread optimism about certain sectors

Arguments against:

P/E ratios have been higher in the past

The "Magnificent Seven" are highly profitable

Investors still show some price sensitivity

Strong earnings expectations for U.S. companies

Key Takeaways

What every investor needs to understand:

Psychology drives bubbles more than prices

Innovation often leads to valuation extremes

Starting valuations heavily influence future returns

The U.S. market is expensive but maybe not in bubble territory

What Should Investors Do?

I’m going to repeat the conclusion I wrote from my article on “The Less-Efficient Market Hypothesis” - a paper by Cliff Asness of AQR.

Howard’s memo talks a lot about the psychology required to create a bubble.

I think Cliff’s gives a good explanation of the current trends that might be driving that psychology.

Cliff concludes that bubbles may occur more often, in larger magnitude, and last longer than in the past.

This means that disciplined, value-based strategies may make more money in the long-term. The downside is that they’re going to be harder to stick with. The periods of underperformance will be more severe and will last longer.

What are investors doing about it?

Indexing more

Hiding in private equity

Moving to momentum / trend following

A side note: Terry Smith has recently pointed out, and I tend to agree with him that indexing and momentum are essentially the same thing. Momentum buys more of whatever is going up. In a market-cap weighted index, you buy more of what's expensive i.e. going up. What should investors be doing?

Cliff offers 5 pieces of advice:

Try to become as logical and rational as possible, while recognizing that you’re human and can’t be perfect.

Study history

Recognize that drawdowns and underperformance feel longer than they are.

The list of previous innovation driven bubbles I wrote in this article is another good thing to understand

Have as long of a time horizon as possible

“a long-term horizon is the closest thing to an investing superpower”

Look at the portfolio, not individual pieces

If you’re actually diversified, something will always be underperforming. Remember why it’s there.

Accept that higher rewards come with higher volatility. Size your positions appropriately

Improve your process

Conclusion

Here are Cliff’s conclusions:

Markets are less efficient

Technology, gamification, 24/7 trading on phones, social media are likely the biggest culprits

Side note: In case it isn’t obvious, if we are currently in or moving towards a bubble, this is what will likely drive the “bubble thinking” that Howard Marks wrote about in his memo

Ups and downs will be bigger and last longer

That will make more money for people who can stick to it long-term, but it will be harder to do so

Indexing is a very reasonable option for those who can’t stick with it

Old-school, active value and quality stock-picking have had lots of people leave the strategies

Creates an opportunity for smart investors to take advantage of

Here’s mine:

I think Cliff makes a pretty convincing argument. If you’ve spent any time at all on social media, especially Reddit or the platform formerly known as Twitter, you’ll see the crowd becoming mob-like.

Warren Buffett’s famous quote is very applicable here:

The Fear & Greed Index is currently in Fear:

BUT - that index talks about what is currently driving the market.

This can easily shift from day to day and week to week.

Looking at the valuations of US stocks, and the concentration in the biggest companies within the US market, I think it’s hard to argue that investors are fearful overall.

That doesn’t mean that bargains and good investments aren’t out there. It just means you should be very cautious and very selective.