This article started as a note I posted on Charlie Munger’s idea that it’s harder than ever to beat the market by investing, but the good news is that you only have to get rich once.

Here’s the essay:

This note got a very thoughtful response. Here it is, in its entirety:

True words but keep in mind what most of them say, and I'm quoting Peter Lynch here, “The most important organ in investing is not the brain, it's the stomach.” Munger also said that “You don't make money while buying or selling, you make money while waiting.” You mentioned the case about Walmart going from $500 to $9M in 50+ years. But did you know that as per Mohnish Pabrai, the only investor/fund to consistently hold Walmart through all this time was the Walton family. Everyone else either never bought it (not realizing how good of a business it was), or waiting for a better price (thumb sucking as what Buffett did), bought too small of a size to really make a difference or sold it too soon (either due to fear or to chase something more attractive in the short term).

Most people haven't done the deep research (myself included) needed to have the conviction to hold the stock in the inevitable ups and downs of the market. So they either never buy, buy too little or sell to soon. You need a special blend of personality - contrarian (to believe that YOU can beat the market and comfortable going against the wisdom of the crowd), curious + hard-working (to do the research), confident (to trust your research and take a meaningful position), humble (to recognize that your research could have been wrong and to sell when wrong even if taking a loss), cheerful + forgiving (to not let past mistakes or losses keep you out of the game). You also need time to do the research and monitor your thesis over time, disposable income which you can afford to take a loss on and supportive spouse who is willing to let you take such concentrated bets (in their understanding, it's a form of gambling for them). You also need to have a good fortune to have been born during the right time, born in the Western countries, well educated and speaking English. I'm sure this is not a complete list of things going your way before you can become a Buffett-Munger style long term, concentrated, value oriented high quality owner of businesses via the stock market.

So yes, it's true that you only need to get rich once and you only need to be right once but that's not possible for majority of people. That's why for most people (myself included), dollar cost averaging in a broadly diversified fund/ETF with plan to hold it long term is the best option as Buffett suggests all the time. You need to know your limitations. To paraphrase Buffett, “Once dumb money acknowledges its limitations, it stops being dumb money.”

This deserves a better response than I can provide in Substack’s notes feature, so I’m providing one here.

Let’s start here:

You also need to have a good fortune to have been born during the right time, born in the Western countries, well educated and speaking English. I'm sure this is not a complete list of things going your way before you can become a Buffett-Munger style long term, concentrated, value oriented high quality owner of businesses via the stock market.

Absolutely correct. Anyone reading this has already won the genetic lottery. When viewed from a global perspective, we are all very likely already rich.

Buffett himself has made the same point. Here’s a quote from a 2020 commencement speech:

"I was so lucky to be born in the United States, and I was lucky to be born in Nebraska. I was a little bit lucky to have the parents I had, and I was lucky to get the education I got. And you go out with a winning hand. That doesn't mean that every single day is perfect, the world isn't that way. But try to think of another country where you'd rather be. Try to think of another era in which you'd rather exist. I don't think you can do it."

That being said, I’ll tackle this statement next:

So yes, it's true that you only need to get rich once and you only need to be right once but that's not possible for majority of people.

Getting Rich Shouldn’t Be Easy

Charlie Munger has made this point as well:

"Why should it be easy to do something that, if done well, two or three times, will make your family rich for life?"

It wouldn't be a lot of money if everyone made $100 million a year. It would be an average salary.

It’s always going to be hard to be in the top few percent of any persuit. Investing is no different.

Fortunately, being a concentrated, active investor isn’t the only way to do well.

In fact, for most people, it is the wrong way. Here are some alternative paths:

Average, or even below-average returns sustained over an above-average length of time can make you very wealthy

You can start a business and it doesn’t have to be expensive or fancy

Painting houses, pressure washing driveways, and lawncare can all be built into very nice businesses

You can invest in real estate

You can invent a product or other valuable IP

Of course, none of these are guaranteed or easy, but again, why should it be?

Should Everyone Index?

Next, I want to tie together the first and last points of the response. They’re both important. I’ll start with the last point:

That's why for most people (myself included), dollar cost averaging in a broadly diversified fund/ETF with plan to hold it long term is the best option as Buffett suggests all the time. You need to know your limitations.

I agree with this statement. Most people should buy the index and wait. It’s the simplest strategy and it’s likely to produce satisfactory results.

Unfortunately, simple doesn’t mean easy, and likely doesn’t mean guaranteed.

Index investing doesn’t require the same time commitment that picking individual stocks does, and it doesn’t require research.

But it does require you to manage your emotions. That’s where the first point comes in:

“The most important organ in investing is not the brain, it's the stomach.” Munger also said that “You don't make money while buying or selling, you make money while waiting.”

No matter if it’s Walmart or SPY, long-term success requires an investor to size a position right, and hold it through a lot of ups and downs.

We’re All Probably Average Investors, Which Means We’re Pretty Terrible.

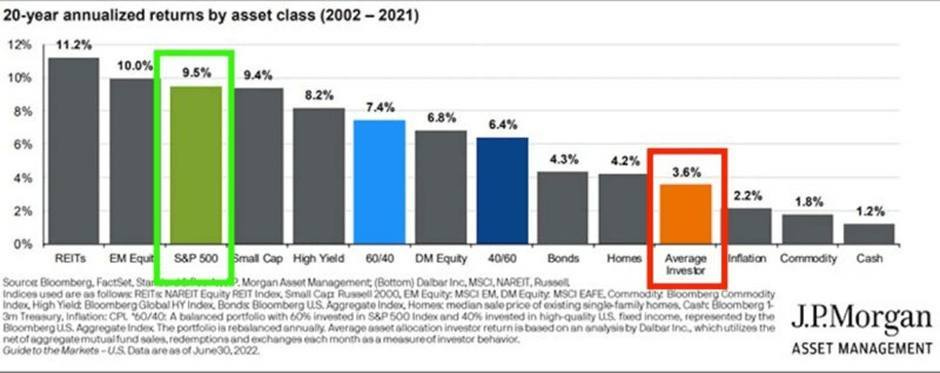

No matter the strategy, investors tend to buy and sell at the wrong times.

The average investor tends to underperform whatever asset or mix of assets they’re invested in.

This suggests that it is not the ability to choose an asset, strategy, or company, but the inability to avoid getting swept up in the market’s emotions that’s the main challenge.

What’s The Answer?

Heck if I know.

Most of what causes our collectively terrible performance is deeply ingrained into our psychology.

So the way to do well as an investor is likely to put less focus on getting the mechanics right and to put more focus on getting your psychology right.

That’s pretty well covered by the entire middle paragraph of the response to my essay, posted at the top of the article.

You have to deeply understand your strategy and what you’re invested in.

You have to believe in it and realize that it will likely underperform. And you have to understand that you need to stay committed to it when it does.

This doesn’t mean that you won’t feel the same emotions as everyone else when the market soars up or crashes down.

You will.

Successful investing has a lot to do with recognizing that your emotions will be telling you to make bad decisions in times of stress, and finding ways to avoid giving in to them.

Howard Marks says there are two paths to outperformance for active investors:

More winners

Fewer losers

For passive investors, there might only be one: avoiding the temptation to time the market and actually remaining passive.

Fantastic read! 😃

It brings up the question for each investor : what is your advantage? What is your edge?

There is always the saying that there are three typical advantages.

1) Informational

2) Analytical

3) Behavioral

I'll argue there is a 4th edge and that is structural. That one came to me from the Talking Billions podcast. A structural edge is knowing which game you should be playing within the field of investing. You can buy and hold. You can day trade. You can work options. Bonds. Crypto. Yikes! 😮

I don't have an informational edge. In fact, there are lots of people who know way more than me,

I don't have an analytical edge. Cheat sheets, a bookmark to Investopedia, notepads, spreadsheets ... you name it, I have that aid next to me! Maybe I have a unique perspective on humanity, behaviors, etc but I wouldn't necessarily call it an edge. It's just my perspective that colors and biases the analysis I am able to do.

Perhaps I have a behavioral edge, or perhaps I am on my way to refining it. Over the years, as I have grown older, I have become much more patient. If I go into something then I do it slowly. Same if I exit. I don't get flustered when markets go up or down. Markets do what they will do and I am powerless to alter their course. So, I adjust my behavior and extend my time horizon.

Structurally, I know which games to avoid. I don't day trade, buy crypto, or dabble in options. Those are games I have an almost zero chance of winning. Therefore, I stay away.

I think if you can understand your advantages and what also resonates the less noble parts of your character then you have made getting rich easier. Not easy. Just easier.

Interesting read! Keep up the good work.