Did you freak out last Friday and Monday when the market dropped?

If you did, you weren’t alone.

Social media was a bigger dumpster fire than normal. Here’s a sampling.

Worse than 2020? Worse than 1987? This is BAD! It’s obviously:

Of course, we now know that the market closed the week like this:

And that it’s up a dismal 12% so far this year:

How did you feel this past week?

If this is the first you’re realizing that anything even happened, kudos. You’ll probably do just fine as an investor.

Did the whipsaw in the market make you anxious?

Did you sell?

Did you panic?

Were you calm?

Did you get excited that the market might continue down, giving you a chance to buy?

I think how you felt last Friday, over the weekend, and on Monday are a good chance to reflect on your temperament as an investor and your strategy.

If you panicked and sold, or spent the weekend in anxiety, you’re not alone.

Loss aversion means that the pain from a loss is worse than the pleasure you get from an equal-sized gain.

It’s one of many cognitive biases working against you as an investor.

If you want the whole list, go read Charlie Munger’s talk on The Psychology of Human Misjudgement.

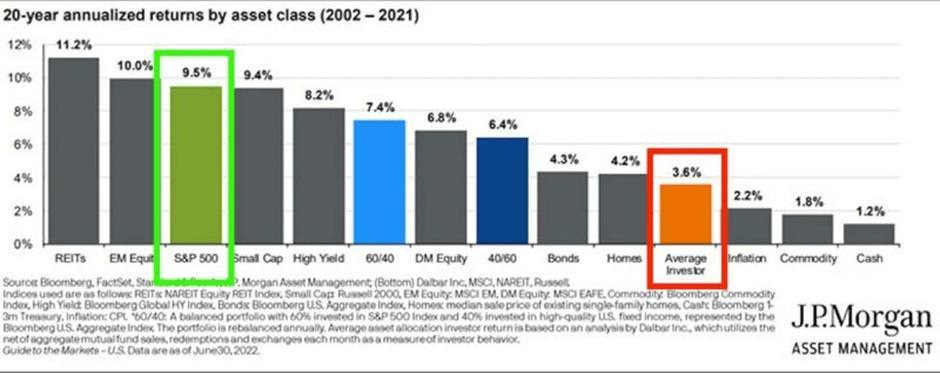

Most Investors Will Underperform

These biases are part of the reason that most investors will underperform.

Not just the market, but EVERY asset class:

To beat the average investor, all you’d need to do is pick an asset class and stick to it.

Which one doesn’t matter - bonds, real estate, small caps; EVERY ONE of them beats the average investor.

Why? Because the average investor buys and sells at exactly the wrong times.

One more piece of social media, this one from yours truly:

But your plan probably isn’t to index.

Otherwise, you probably wouldn’t be reading this. So let’s find some advice that will help the next time the market drops.

I’m not going to make predictions. I have no idea when the next market crash will come.

The market could head down on Monday when the market opens and keep going down this time. It could be another decade. It doesn’t matter to me or for my strategy.

I’m not going to tell you what strategy you should follow. I’m going to let Joel Greenblatt do that.

Joel Greenblatt on investing strategy

Greenblatt believes that your strategy needs to be simple. Here’s the first sentence from the investment philosophy section of the Gotham Funds website:

Our investment philosophy for all of our funds is simple, straightforward and consistent.

William Green interviewed Greenblatt in “Richer, Wiser, Happier.”

A good portion of the interview focused on Greenblatt’s ideas about simplifying your investing strategy.

Green broke it down into 4 points:

You don’t need the optimal strategy. You need a sensible strategy that’s good enough to meet your financial goals.

Your strategy needs to be so simple and logical that you understand it, believe in it, and can stick with it in the difficult times when it no longer seems to work.

You need to ask yourself if you have the skills and temperament to beat the market.

Remember that you can be a rich and successful investor without attempting to beat the market.

Let’s briefly discuss each one.

You don’t need the optimal strategy.

First, what does “optimal strategy” mean?

Optimal right now?

Optimal for the long term?

Highest returning?

Lowest volatility?

It’s a slippery term. What most investors engage in is chasing returns.

Nvidia is up, AI is hot, and your neighbor just bought a boat with his crypto gains.

In 2008 house prices were never going to come down, and in 2000 pets dot com was going to be the next millionaire-maker.

Don’t chase the hot strategy. Pick one that makes sense to you and that will meet your goals.

Your strategy needs to be simple and logical.

Is it simple and logical to explain why NFTs will go up?

Can you simply explain why your short-vol strategy will keep working? Is it logical that the VIX will stay at historically low levels?

Whatever strategy you pick, it will have periods where other strategies outperform it.

Even indexing will underperform. US stocks underperformed world stocks from about 1985 to 2000.

If your strategy isn’t simple and logical, you won’t really understand it.

If you don’t fully understand it, it’s hard to see why it’s underperforming and to believe that it’ll return to performing well in the future.

Without a full understanding, you won’t believe in your strategy and you’ll abandon it when it underperforms.

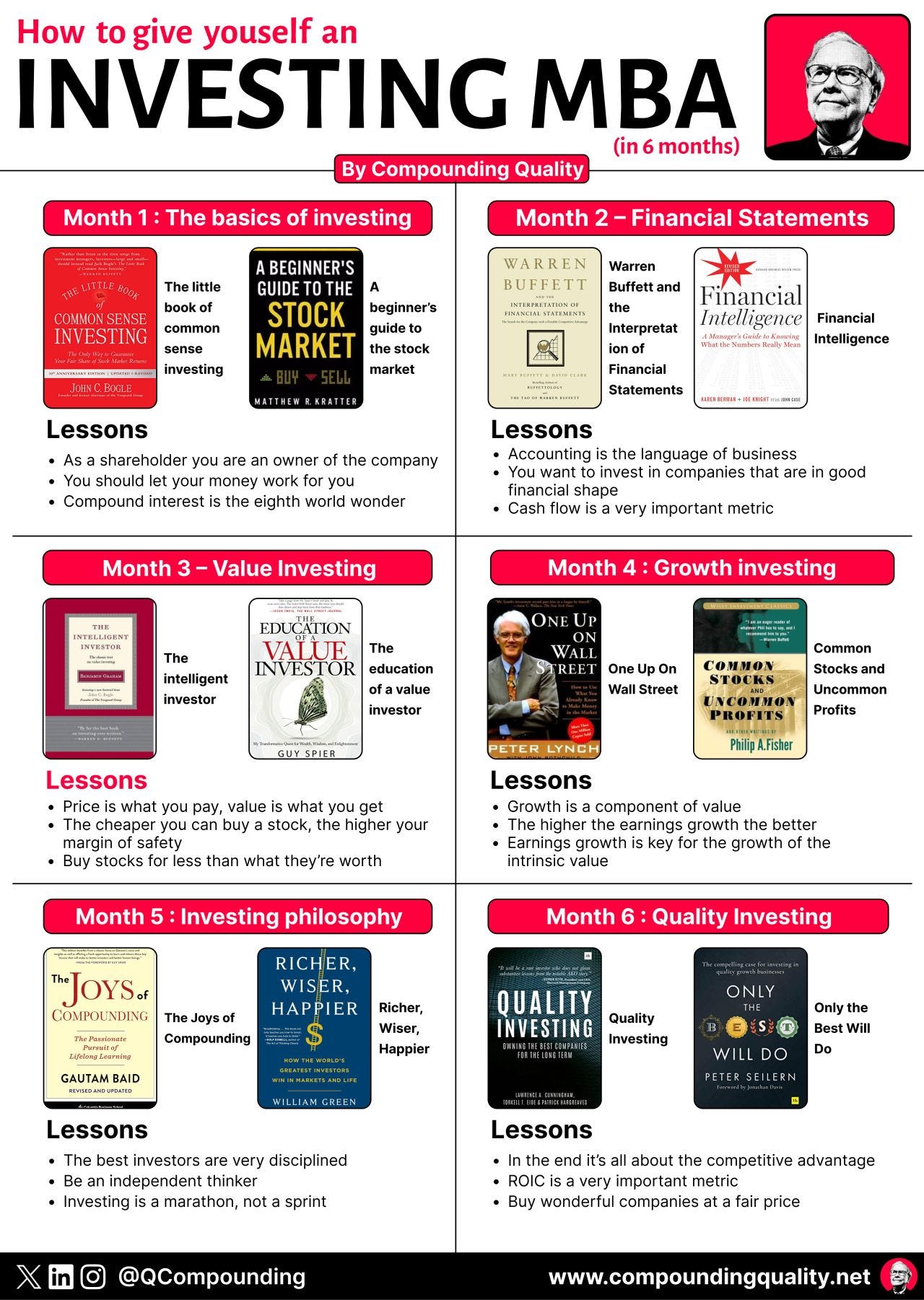

You need the skills and temperament to beat the market.

The skills aren’t that hard to learn. There are plenty of books that will teach them to you.

Here’s a pretty good list from Compounding Quality.

Temperment is more difficult. François Rochon theorizes that most people have a “tribal gene” that makes people follow the majority.

But Rochon thinks “about 5%” of people don’t have this gene, letting them act independently from the group.

He thinks this sets these people up to excel in areas like investing.

The ability to resist popular trends and make contrarian decisions can lead to better-than-average returns in the market.

You should assess for yourself if you have this kind of temperament.

If not, no worries!

You can be rich and successful without beating the market.

$35,000 invested over 30 years with an additional $7,000 each year gets you close to $1 million.

"You can be an extraordinary investor by earning average returns for an above-average period of time."

- Morgan Housel

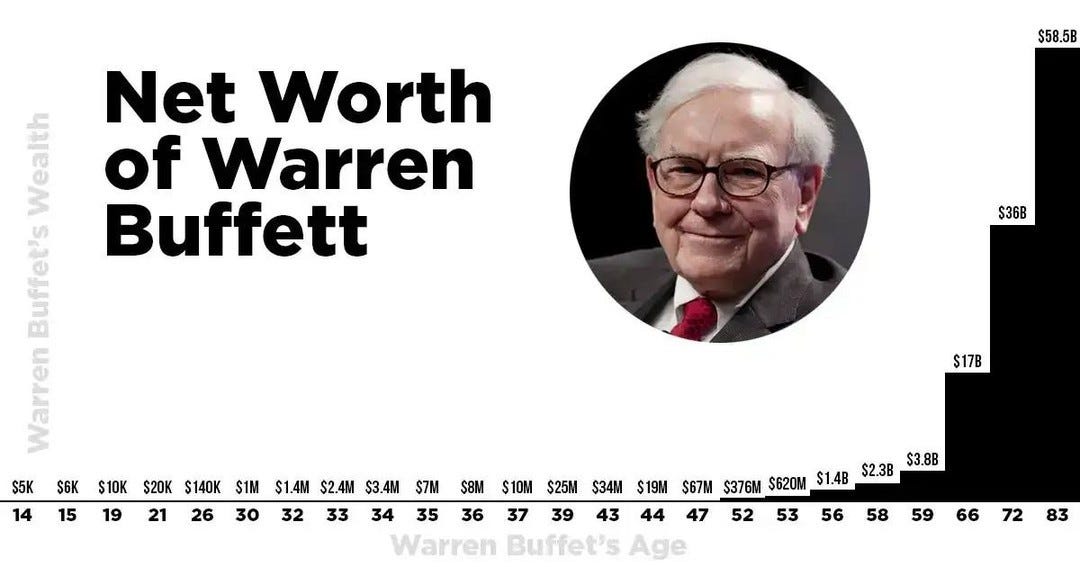

Buffett's returns have been above average, but time is a major component of his success.

Again, you need a simple strategy that you understand and can stick with for long enough to let the magic of compounding work for you.

The right strategy for you:

I don’t know what it is. But if the recent market turmoil rattled you, I think you should spend some time thinking about it.

You don’t have to follow the same strategy I do, but I’d suggest:

Picking a simple strategy that you fully understand and believe in

Avoiding trying to keep up with the hot business or sector

Not trying to time the market

Allowing your money to grow steadily for a long time

Even if you weren’t rattled this week, reviewing your strategy and reminding yourself why you follow it isn’t a bad idea.

I really liked this article.

So true, yet you see people jumping from one strategy to another all the time.