PayPal Update

Still a no-brainer

It’s been about a year since I talked about PayPal. Here are the last articles if you missed them:

Since those articles were written, PayPal has changed nearly all of the management team, and we have 4 more quarters of data to analyze.

I’ll go ahead and put the conclusion up front:

TL;DR

PayPal is a healthy company trading well below intrinsic value. I liked PayPal last year and I like it even more now. Here’s why:

PayPal continues to grow revenue and earnings.

PayPal generates massive amounts of free cash flow

They recognize that they’re cheap, so they’re buying back shares

The shareholder yield for PayPal is around 7% right now. They’re growing at about 8% per year - that gets us to a 15% return per year without multiple expansion

I think the market is missing the fact that PayPal is the only payment provider that has data proving that they make merchants more money.

The Business

I’m not going to totally review the business. If you don’t know PayPal, the last two articles have a complete history of the company and an overview of everything it does.

I will give some quick highlights.

My view is that the most important thing to focus on is the merchant side.

PayPal initially built their position by creating a 2-sided network. For consumers, they were a safe, easy way to make online payments. For merchants, PayPal provides security, high auth rates, lower fraud rates, and helps them sell more.

Consumers

When PayPal started, there weren’t a lot of ways to make payments online, and smart phones didn’t exist. PayPal was safe, easy, and convenient.

PayPal is still safe, easy and convenient, but there is more competition here. There’s Apple Pay, Google Wallet, Cash App, Zelle.

I don’t think this is as big of a deal as the market thinks. To understand why, we have to look at the merchant side of things.

Merchants

Despite the increasing competition on the consumer side, PayPal still dominates electronic payments:

Here’s why:

Merchants who use PayPal as their payment provider make more money.

The reason that this is true now and that it will stay true in the future is because PayPal has more data and understands consumers better than the competition.

That’s the moat. That’s what you need to know to understand my PayPal investment thesis.

PayPal uses their consumer data to do things nobody else can do.

PayPal has 6 to 8% higher auth rates than competitors

PayPal provides faster checkout with better sales

StubHub saw 50% more revenue per customer with PayPal's one touch checkout

A Neilsen survey showed

28% higher conversion with PayPal checkout

a 19% increase in unplanned purchases

a 13% increase in repeat purchases

and an 8 point gain in NPS

Buy Now Pay Later is another good example:

PayPal uses their data to extend more credit to people with lower credit scores than anyone else. Because of the amount of data they have and how well the models work, BNPL is offered at no additional cost to the merchants.

Consumers and merchants both get what they want. This looks similar to Nick Sleep’s idea of “scaled economy shared.” This shows in PayPal’s BNPL market share:

To give you an idea of how good PayPal’s data is, consider the deal with KKR. PayPal is so good at underwriting that KKR is trusting PayPal to do it. If the loans don’t get paid back, KKR is the one on the hook.

The newest use of PayPal’s data is Fastlane:

Fastlane focuses on making guest checkout easier. The way I understand it is this - if you buy something online using guest checkout and save your information, typically that information only gets saved to that specific website.

For merchants using PayPal, that information will get saved to PayPal. The next time you go to a website that also uses PayPal for payments, your guest checkout is now a 1-click experience.

This was announced last summer, but the market didn’t pay much attention. Here’s John Kim from last year explaining why this matters:

When consumers come to a checkout today and they pick PayPal, we typically see a conversion rate that’s nearly 90%. When a consumer decides that they want to use a guest checkout, we see a massive erosion, typically around 50% to 60% conversion.

Fastlane has started to roll out. Here’s new CEO Alex Chriss from the Q1 2024 call talking about what they’re seeing:

Alex Chriss:

“The only thing that I would -- just last point is this conversion rate with Fastlane, what's so exciting to me is not just the 40% that's coming in, it's unrecognized users leveraging our brand and the 80% conversion rate of guest checkout for returning users. But this is just early days. This is with a handful of merchants.”

You see why I think the merchant side is important?

PayPal can go to merchants and say “use us, we’ll make you more money.” No other payment solution can do that.

That’s why PayPal dominates and will continue to dominate electronic payments.

We can see it in their metrics.

PayPal Continues to Grow

This is a quarterly view of revenue and operating income.

Here are annual growth rates for revenue and net income:

PayPal isn’t growing like a tech startup at 20% a year, but that’s an unreasonable expectation. PayPal has been around since 1998. They’re massive. PayPal’s active accounts are equal to every adult in the United States, Canada, Germany, the UK, and Australia using PayPal.

Speaking of accounts, the market is worried about slight declines in accounts.

It’s true that PayPal is seeing slight declines there. But look at payment transactions and transactions per account. The people who use PayPal are using it more.

PayPal is Profitable

PayPal makes plenty of money. Here are their gross and operating margins.

The market is worried about the declines in gross margins. I’m not. They’re still around 40%. And much of the decline is because PayPal lowered prices on their unbranded Braintree product to take market share. Alex Chriss has said he plans to move towards “value-based pricing”. Read this as raising prices.

I think customers will tolerate that just fine, considering PayPal’s ability to make them more money. Look at Fastlane - would you pay a few percentage points more to double your conversion rate? I would.

PayPal is a Free Cash Flow Machine

I feel like at this point, I should address another market concern with PayPal - stock-based comp. Yes, they have given out a fair number of shares in the past. Considering their silicon-valley based history, it’s not terrible. Alex Chriss has also made some comments about reducing SBC. They’ve also started including it as a cost in their non-GAAP metrics. I really like that move.

But with all the FCF, PayPal is in a net cash position:

PayPal is Shareholder-Friendly

And they’re buying back lots of shares:

That leads to high shareholder yield:

PayPal is cheap

PayPal knows they’re cheap. That’s why share buybacks are giving us a 7.5% to 8% shareholder yield.

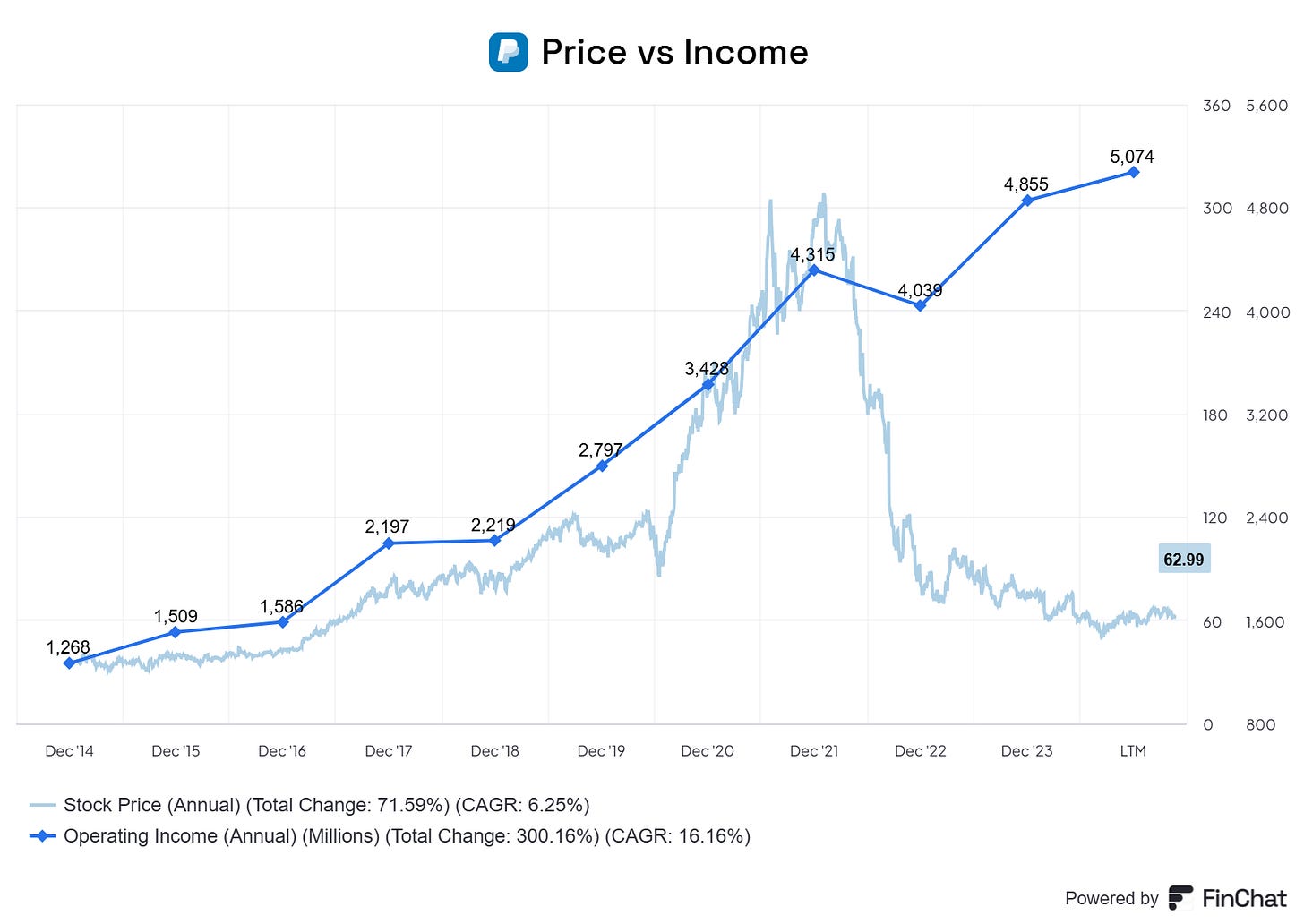

How cheap? Peter Lynch says stock price should follow earnings. If that’s true, PayPal either has to start making a lot less, or the stock price has to go up:

PayPal is also cheap on a historical basis. Here’s forward P/E and FCF yield:

PayPal is a no-brainer

The Downside is Limited

PayPal continues to have a strong market position. They have an intrinsic advantage with their data. Based on the fact that they make merchants more money, they should have pricing power. The balance sheet has a net cash position. Sentiment on the stock is very low. I’m not saying PayPal can’t trade lower in the future. But the future of the business looks pretty secure to me.

The Upside is Asymmetric

Let’s say the market continues to hate PayPal and it keeps trading sideways. Then investors sit around and get 7% or 8% shareholder yield as PayPal keeps buying back stock. At the rate it’s going, in about 6.5 years, PayPal could buy back 50% of the market cap. That should double the stock price, meaning a CAGR of about 11%. Not bad.

Long-term estimates are that PayPal keeps growing at 8% a year. 7% shareholder yield + 8% growth = 15% returns. Again, not bad.

None of this considers multiple expansion.

Go back and look at earnings plotted against price and the forward P/E charts. I’m not counting on multiple expansion, but I don’t think it would take much to see it.

As I said, sentiment is low. Any kind of unexpected growth could trigger multiple expansion on top of the organic growth and buybacks.

What’s PayPal worth? I don’t know exactly. What I do know is that it’s worth a lot more than it’s currently selling for, and it’s returning capital to shareholders at an attractive rate. That’s good enough for me.

What about Apple?

Everything above this section was written before Apple’s WWDC event. They announced some changes to Apple Pay that drove PayPal stock down further. The main concern is that Apple Pay users will be about to use it in browsers other than Safari.

I don’t see a big issue here. Access to Apple Pay is still limited to only people who use iPhones. Yes, it creates more competition on the consumer side, but I think at this point the consumer side is basically a commodity. PayPal jumped out to an early lead with consumers and still has a huge number. It seems to me that the market is still trying to price PayPal based on user growth, like it’s a young company. If this were the case, the Apple announcements would matter.

That’s not the case though. PayPal has a huge user base. Yes, the count has been very slowly shrinking, but the users who remain keep using PayPal more. Their financials are growing and they continually process more transactions. The business side is the most important piece of PayPal now.

This is where they can differentiate. Fastlane is a great example of this. With Fastlane, everyone who uses the guest checkout of a merchant using PayPal as their payment provider has essentially become a PayPal user. This won’t show up in the active accounts metric.

PayPal also announced their plan to move into advertising. This is another great example of what they can offer.

Again, PayPal is the only company that can go to merchants and show that using them as the payment provider can drive more sales. As long as they can do that, their future looks pretty bright to me. Or at least not as apocalyptic as the market seems to be predicting.

As always, this is just my view. You should do your own research.

Nice article, thanks :)

One question that keeps puzzling me - in general, not necessarily limited to Paypal: what kind of dynamic causes gross profit margins to trend lower but operating margins to be steady or even increase?

I wonder if there is a pattern to be recognized among different companies.