‘I view the markets as fundamentally broken…Passive investors have no opinion about value. They’re going to assume everybody else has done the work.’

— David Einhorn, president of Greenlight Capital

That’s a big statement, but Einhorn does make a logical argument for his view.

He says that most investors fail to consider value; instead, they consider price.

Einhorn reasons that because most of the market is no longer figuring out the true value of a company, value managers no longer benefit from asset prices reverting towards intrinsic value.

This creates a vicious circle. Value managers continue to underperform, causing redemptions as money moves into other strategies.

The value managers become forced sellers, so value stocks fall further. This triggers more redemptions, and the cycle continues.

‘All of a sudden, the people who are performing are the people who own the overvalued things that are getting the flows from the indexes. You take the money out of value and put it in the index, they’re selling cheap stuff and they’re buying whatever the highest multiple, most overvalued things are in disproportionate weight. That’s a change in the market and it’s a structure that means almost the best way to get your stock to go up is to start by being overvalued.’

— David Einhorn, president, Greenlight Capital

If Einhorn is right, what’s an investor to do?

He gave us the answer in his letter to Greenlight clients in January of 2024:

‘We believe that the strong returns and alpha from the long book came from a successful adaptation of our style. We have become even more disciplined about price and emphasize investments where we get paid by the issuers, as opposed to relying on other investors to revalue the security. Payment can come to us in the form of buybacks, dividends, interest, or in some cases, a take-out from a buyer. With the decimation of the active fund management industry, we don’t believe we can reasonably expect securities to be re-rated by investors who are actively trying to figure out what they are truly worth. Many of our largest holdings are offering double-digit returns directly to investors.’

— David Einhorn's Greenlight letter 1/22/24

I don’t know if David Einhorn is correct.

I do know that passive funds closed 2023 with more assets than active funds.

I also know that the MSCI World Growth Index has been outperforming the World Value Index for a long time.

Whether Einhorn is right or wrong doesn't matter to me. Looking for undervalued companies with attractive shareholder yields is a good idea.

Especially when we combine David Einhorn’s ideas with this quote from Charlie Munger:

‘We have no system for having automatic good judgment on all investment decisions that can be made. Ours is a totally different system. We just look for no-brainer decisions. As Buffett and I say over and over again, we don’t leap seven-foot fences. Instead, we look for one-foot fences with big rewards on the other side. So, we’ve succeeded by making the world easy for ourselves, not by solving hard problems.’

Mohnish Pabrai also often talks about no-brainer investments and anomalies in the market. Maybe he learned those ideas from Charlie.

Enter Brainless Investing

As more of the market focuses on price instead of value, it is becoming more and more brainless. Take a look at PayPal’s operating earnings VS the share price.

I’m not arguing that PayPal is the greatest business ever. I'm not arguing that it should trade at $300 like it did during the pandemic. Yes, there’s more competition than ever, but that earnings line looks pretty good. If price follows earnings, what’s going on here?

Considering all of the above, I’m refining my strategy. I’ll be looking for companies in 2 major buckets.

1 - High Shareholder Yield

Finding a company trading significantly below the intrinsic value is no longer enough. I’m looking for underpriced companies that recognize it.

In other words, I’m looking for underpriced companies that are intelligently returning capital. That might be through significant dividend payments, share buybacks, or debt paydown.

We don’t need the market to be smart enough to figure out what these types of companies are worth. We just need management to keep making money and returning it to shareholders.

It turns out, there’s research to support this idea.

Shareholder yield appears to lead to good returns with reduced volatility. Not a bad thing.

2 - True No-Brainers

The market may be mindless most of the time, but it also occasionally loses its mind. These are the easy, no-brainer investments Charlie Munger talked about. Mohnish Pabrai would call them “anomalies”.

They could be created by macro or company-specific events. They could come from investing mandates like ESG created with coal companies. They could come from irrational investor behavior like Mohnish Pabrai found with Reysas in Turkey. They might be what Ben Graham would call “unpopular large caps.” The reason doesn't matter. Auction-driven markets occasionally offer good businesses up at ridiculous prices. Prices we can take advantage of.

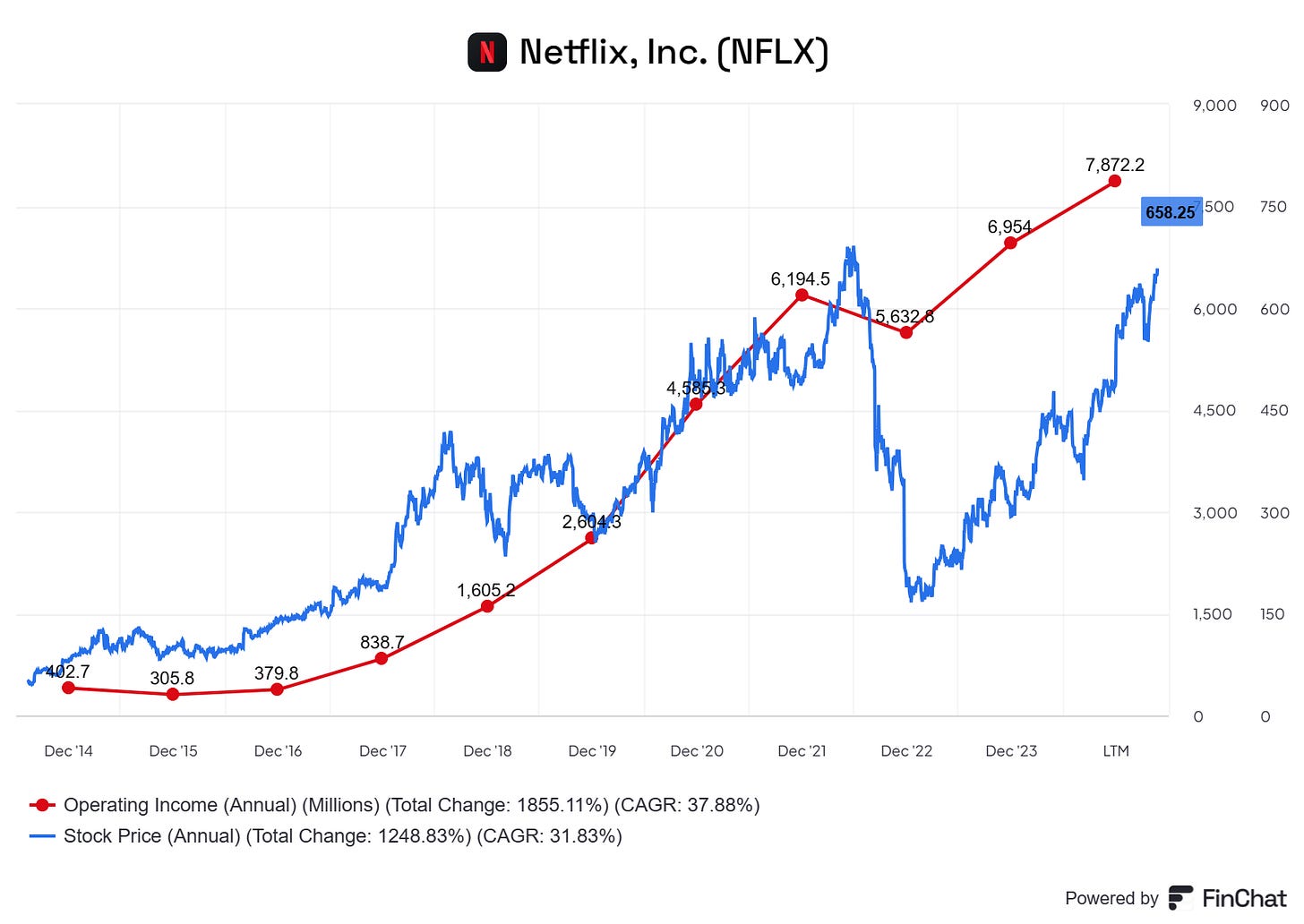

Here’s an example - remember in 2022 when Netflix lost subscribers for the first time in a decade? The market lost its mind. Here’s the operating income VS stock price chart for Netflix.

This was just short-term panic. In 2021 and 2022, Netflix was profitable, with a solid balance sheet. They saw a massive spike in new subscribers during the pandemic. Expecting everyone to stick around forever was unreasonable.

I still believe that buying quality companies at reasonable prices will yield fabulous results.

The problem is that quality is expensive, and I don’t see it getting cheaper very soon.

Cintas and Costco have to grow at over 20% a year for the next decade to get a 10% return. Right now, Cintas’ long-term projected growth rate is 12% and Costco’s is 9%. They’re both well followed, and these projections are likely reasonable.

I’d love to own both, but not at those prices. Good businesses aren’t always good investments.

I’m going to have to rely on events and anomalies to buy the best businesses with a reasonable expectation for good returns.

Then What?

Nothing. That’s the best part!

The plan is to sit on the company and watch to make sure it’s still performing as expected.

Either I'll own a good company that is paying me directly - the best form of Warren Buffett’s equity bond. Or I’ll own a high-quality compounder, bought at a significant discount.

As long as the company remains a good investment, the job is to circle the wagons.

What’s It Look Like Moving Forward?

Moving forward, other than reading and thinking, I expect to do a lot of nothing.

I expect no-brainer ideas to be rare. There will be years I don’t find any. There will be years I find two or three. Searching for direct returns and true no-brainers tightens up my already tight criteria. That’s just fine.

I’ll get bigger “no” and “too hard” baskets, then get to work filling them up.

Hi TJ. I really like your approach and mindset.

Do you have any views on ASML today. Do you consider it a no brainer ?

Excellent article. I too have a newfound appreciation of shareholder yield. Now we hunt and lie in wait... easier said than done 😁