It’s been almost a year since I’ve done an update on Charles Schwab.

A lot has happened since the last one, so it’s probably time that I comment on what’s been going on with the business and the stock.

Here are the first two articles on Schwab if you’re interested:

If you don’t read the past articlesf, here’s the quick summary:

I bought Schwab during the March 2023 banking crisis.

After looking at their bond portfolio and business, I concluded that Schwab was very likely safe from any sort of catastrophic bank run scenario, and trading at an attractive valuation.

After owning Schwab for a while, I concluded that their business model was even stronger than I initially realized - looking very much like a “scaled economy shared” type of business.

At the last update, Schwab Bank was the concern for investors - clients were moving cash out of the bank and into higher paying money market funds and CDs to take advantage of the higher rates created by the Fed’s aggressive interest rate hiking.

Here’s what I concluded almost a year ago:

“Because of the interplay of interest rates, regulatory changes, investor psychology, and market performance necessary to forecast Schwab’s performance over the next quarters and 1 to 2 years, it’s incredibly difficult. Perhaps impossible. But this is a fabulous example of Mohnish Pabrai’s 5th commandment of investment management:

A long-term investment in Schwab at this point requires a view on 2 things:

Will Schwab continue to grow assets under management?

Will Schwab be able to generate attractive rates of return on a small portion of assets under management?

Like all investments, it also requires a view on if the business will survive in the long run.”

With that backdrop, let’s do an updated on what’s been going on.

Current Concerns

Bank Outflows

These are slowing as management expected. Investors don’t seem overly concerned about this at the moment. In July, Schwab put this in the earnings presentation:

Slowing bank sweep outflows despite robust client engagement

Excluding balances transitioned to support growth in margin debits, net client bank sweep outflows in 2Q have been less than the cash flows from the investment portfolio received in 2Q

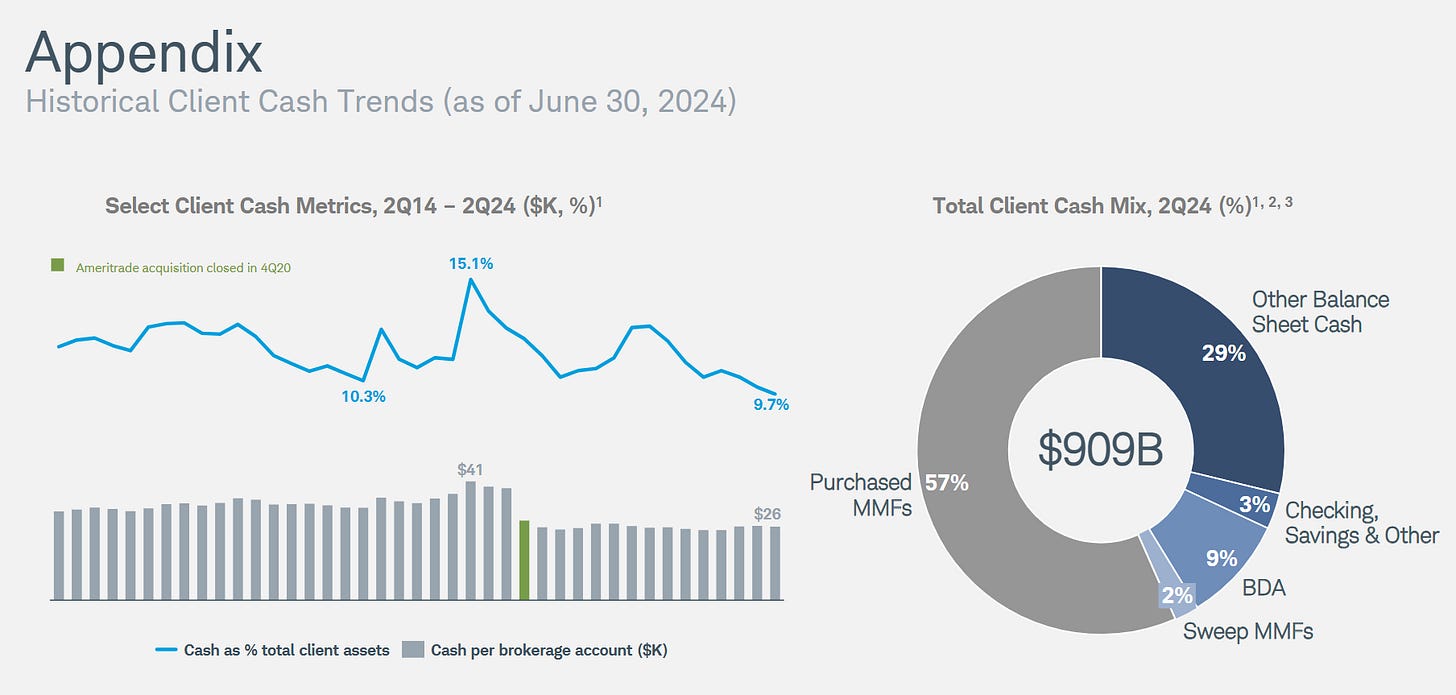

You can see that cash per brokerage account has pretty much stabilized. Cash as % of total client assets is declining because people are investing a larger portion of their cash.

Interest Rates

Fluctuating interest rates and their impact on net interest margin (NIM) have raised concerns.

Net interest margin is a metric commonly used when assessing a bank. Here’s what you need to know:

Calculated as the difference between interest income generated and interest paid out.

A higher NIM indicates greater profitability from lending activities.

Here are Schwab’s interest income margins from before the GFC:

2001: 3.5%

2002: 3.38%

2003: 2.69%

2004: 2.07%

2005: 2.73%

2006: 3.26%

Here they are for the past 4 years, and the most recent quarter:

2020: 1.62%

2021: 1.45%

2022: 1.78%

2023: 1.98%

Q2 2024: 2.02%

You can see a pretty steady trend up. Management is guiding for near 3% by the end of 2025.

Regulation and Lawsuits

Schwab generates around half of their revenue from the banking side.

The way Schwab generates a lot of that revenue is by taking the cash that clients leave uninvested in their accounts and sweeping it on to the company’s balance sheet. They then invest some portion of that money into things like treasuries, mortgage-backed securities, etc. Some of it they just put into a higher-yielding account with another bank.

They pay the clients less than what they’re making on the invested money and keep the spread.

This model is what let Schwab cut commissions to zero. They were not reliant on trading revenue for income.

Pretty much all of the brokers that let you trade for free use this model.

There are class action suits against a lot of them, including:

Charles Schwab

Wells Fargo

J.P. Morgan

Raymond James

Morgan Stanley

Ameriprise

UBS

BofA’s Merril Lynch

The compliant is that the banks and investment advisors didn’t adequately disclose that clients could make more money elsewhere.

I don’t think this is cause for concern. I’ll quote Schwab’s management on why:

In the 2023 4th quarter call, CEO Walt Bettinger said this:

"For Schwab stockholders, it was a difficult year. Our stock lost about 17% of its value. The core reasoning behind most of this decline is our commitment to proactively following our "through client's eyes" strategy. Because throughout 2022 and 2023, we reached out to our clients and encouraged them to move their yield-sensitive, or what we sometimes refer to as longer-term investment cash, into higher-yielding alternatives. And they did, to the tune of several $100 billion. And an and aside although these actions have temporarily impacted our revenue and earnings, we would do the same thing every time. The client loyalty that we build by being proactive will pay dividends in the long-term as clients continue to entrust us with their investment dollars.”

In the 2nd quarter call from this year:

we have provided money market fund sweep cash and -- or money market yields on bank cash for all of our fiduciary-driven investment advisory solutions already. So, I don't really see the Wells Fargo report having any kind of meaningful implications for us. We've been doing this for an extended period of time already

And from a company spokeswoman:

“When clients choose a self-directed approach, they have full control over their assets and cash management decisions,” the spokeswoman said in a statement. “That means they have access to a wide range of cash solutions and information to help them choose the solutions that best fit their individual needs. Our offerings provide safety and liquidity to meet everyday cash needs, and our clients value the option of FDIC insurance protection combined with convenient access to their cash. If you would like to know more about our bank sweep and cash offerings, please read our disclosures. It’s evident that these plaintiffs’ lawyers did not.”

I don’t know what happens to everyone else, but I think Schwab is OK here.

TD Ameritrade Integration

There was some concern over how many TD Ameritrade clients and advisors would stay with Schwab, and how they’d like the new platform. It seems to be going well. Again, CEO Walt Bettinger from the Q2 call:

“That attrition was well below what our expectations were. And now we're seeing what we'd expect to see in the next phase, which is client satisfaction from those clients that were moved, who had their experience change, improving dramatically. We're up 35 points in our advisory services business in terms of our overall client promoter scores following the conversion. And on the retail side, nine months after a client moves, their satisfaction is up 50 points.”

TD Bank Selling Shares

Another source of noise was TD Bank selling about $1.4 billion worth of Schwab stock they got when they sold TD Ameritrade to Schwab.

This move was totally to raise cash for the $2.6 billion fine they got for failures in their money laundering controls. It’s got nothing to do with Schwab’s performance.

Changes in the Banking Business

In July, management announced changes coming to their banking business. Specifically, they said they planned to:

Reduce the duration of assets on the balance sheet

Reduce assets held at Schwab Bank by increasing utilization of 3rd party banks, as long as it can be done without reducing the profitability of the company.

This is going to be a years-long process. The goal benefits are:

Reduces the comapny’s capital intensity

Increases liquidity

Extends FDIC protection for clients by splitting assets among banks

The downside is that there will probably be more volatility of earnings over an interest rate cycle. However, this protects them from a sudden surge in rates like we recently saw.

This has the market worried, because the bank makes Schwab a lot of money.

Long-term I think this is a good thing.

These moves will make Schwab more nimble and less reliant on interest rates.

With rates moving back to normal, shorter-term bonds get rid of the duration risk that Schwab was forced to take when rates were near zero. I don’t think that environment is coming back any time soon.

Schwab still plans to lend against assets held at the bank and brokerage, as well as on residential mortgages, and HELOCs on their mortgages. Higher rates benefit this as well. Schwab currently has way more deposits than mortgage demand. Lowering the amount of deposits held at Schwab means they have to hold less capital in reserve, letting them loan a larger portion of their total deposit base out -raising NIM.

Schwab is growing it’s advisory services:

Its Modern Wealth Solutions saw 30% year-to-date (YTD) enrollment growth and 56% YTD inflows of $25 billion into its Managed Investing solutions.

Client assets receiving ongoing advisory services rose 16% YoY.

Margin balances rose 15% since the end of 2023 to $71.7 billion.

These are all profitable parts of the business that should make up for any loss of revenue from the changes at the bank in the long run.

Conclusion

Charles Schwab still has a lot of noise and uncertainty around the stock in the short run.

Going back to the 2 points I said we needed to have a long-term view on:

Will Schwab continue to grow assets under management?

So far, the answer seems to be yes. Based on the fact that the attrition from the TD Ameritrade integration was lower than projected, and the promoter scores are going up, I say yes. So does the data:

Here’s Schwab’s 5-year revenue growth compared to JP Morgan and Morgan Stanley.

They have consistently grown faster than both.

Scwhab’s is trending down from an abnormal spike from the TD Ameritrade acquisition.

Will Schwab be able to generate attractive rates of return on a small portion of assets under management?

Again, I think the answer here is yes. Schwab’s management team has been proven to be very long-term oriented, which I love.

Things are also trending in the right direction.

Here’s revenue and net income on a quarterly basis:

Here’s Schwab’s net margins compared again to JPM and MS. They’re doing just fine.

My views on Schwab in the long-run haven’t changed. I think they’ll keep growing assets under management, and remain profitable.

I really like the management team, and I trust them with my money. They’re long-term thinkers who believe that doing what’s right for the clients will be the right move for the business.

Well done, Mr. Terwilliger! 👍

I think there was a lot of fear that the Schwab story would collapse with the softer banking performance and lower income. That spooked a lot of people (algorithms?) and the price saw a decent decline. 🤷

The story may indeed be less compelling than it could have been. There are other stories that could perhaps outshine Schwab's - Ameriprise, Amazon, Kinsale, Visa/MasterCard, etc.

I also bought in through the bottoming of the banking crisis in 2023. A little bit at a time, over time, until the plate was full so to speak. With dividends reinvested I feel like I am sitting pretty and doing OK. However, if I see a -20% drop elsewhere like Berkshire or something wild like that, then I may rotate out slowly. I'm not married to Schwab, so we'll see. 🤔

In the meantime, Schwab isn't going anywhere. It's fine. Go enjoy the outdoors, a podcast, or go read something on CQ in the meantime. 😀