I was recently asked for an opinion on Hims & Hers.

A few things you should know upfront before you read this article:

This is not the type of company I’m likely to ever invest in. It’s only been public since 2018 and it’s only profitable on TTM metrics. It looks like it’ll probably make some money this year, we’ll see.

I’m automatically very skeptical of anything heavily pushed on social media.

I generally stay away from anything pharmaceutical related.

So HIMS has a few strikes against it going into this.

But I thought it might be an interesting article to show you how I get to a “no” or “too hard” as quickly as possible.

Start with the business

Question #1 - “Can I understand this business?”

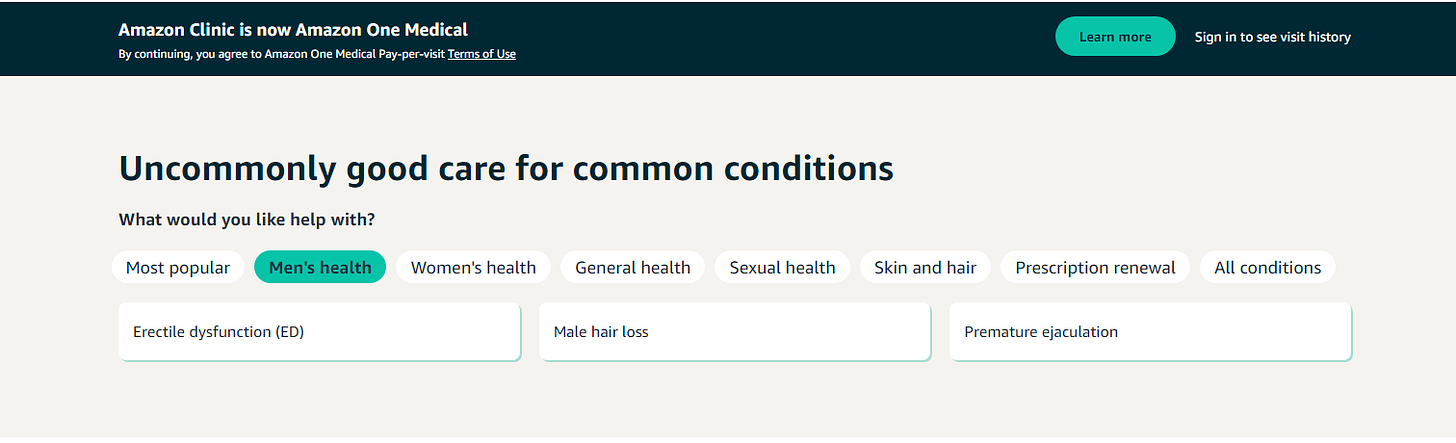

Hims isn’t too hard to understand. They’ve built a platform where people can have a telehealth visit, then get a prescription mailed to them. Hims & Hers focuses on:

Sexual health

Hair loss

Skincare

Mental health

Weight loss

Hims & Hers runs the platform. They have a network of providers that work solely for them. They then partner with pharmacies and manufacturers to make and distribute the products.

For this, I just went to the most recent 10-K and read the first section - “business”.

A few red flags are popping up to me right away.

Let me throw a few quotes from the 10-K your way:

(Hims & Hers) has built a consumer-first platform transforming the way customers fulfill their health and wellness needs. We believe that the Company has the technical platform, distributed provider network, and access to clinical capabilities to lead the migration of routine office visits to a digital format.

That’s a big vision. We’ll come back to that.

The Hims & Hers platform includes access to a highly-qualified and technologically-capable provider network, a clinically-focused electronic medical record system, digital prescriptions, and cloud pharmacy fulfillment.

Sounds impressive, but these are table stakes to play in healthcare.

What are my concerns from the first section of the 10-K?

I see nothing proprietary here. Hims has telehealth, generic medications, and home delivery from an online pharmacy.

They’re touting the fact that they have the basic pieces in place to deliver their non-proprietary service. Unimpressive if you know the healthcare space at all.

“transform the way customers fulfill their health and wellness needs” and “lead the migration of office visits to digital” this deserves it’s own paragraph…

Teladoc has been in existence for over 20 years. They’ve never made money. They haven’t pushed everyone to online visits. I’m skeptical a hair-loss / skin care / ED treatment company is going to do that.

Let’s talk about “transforming healthcare” next.

Healthcare in the US is not a good system. Everyone knows it’s a bad system, but nobody has been able to fix it.

Exhibit 1: Haven Healthcare

Haven was a venture by Amazon, JPMorgan, and Berkshire Hathaway to disrupt healthcare. Here’s how it launched:

Haven Health is About to Disrupt the U.S. Healthcare System

And here’s how it ended:

“Healthcare Is Hard”: Reflections on the Collapse of the Haven Experiment

If Amazon, JPM, and Berkshire couldn’t do it, I’m very skeptical that Hims can.

An important note on Haven - it focused on employee healthcare, which in theory should be the easiest to disrupt. The employers have every incentive to improve things to lower their costs, have their employees healthier, and missing less days at work. The providers and healthcare companies should want to serve those three companies, they’re huge. That’s a lot of employees and a lot of business.

The venture lasted less than 3 years.

Let’s move on. With my initial findings from that section, I’m moving on to:

Question #2 - “Does this business have a moat?”

I’d normally head here no matter what, but based on what I learned about the business, this is absolutely where I’m going next.

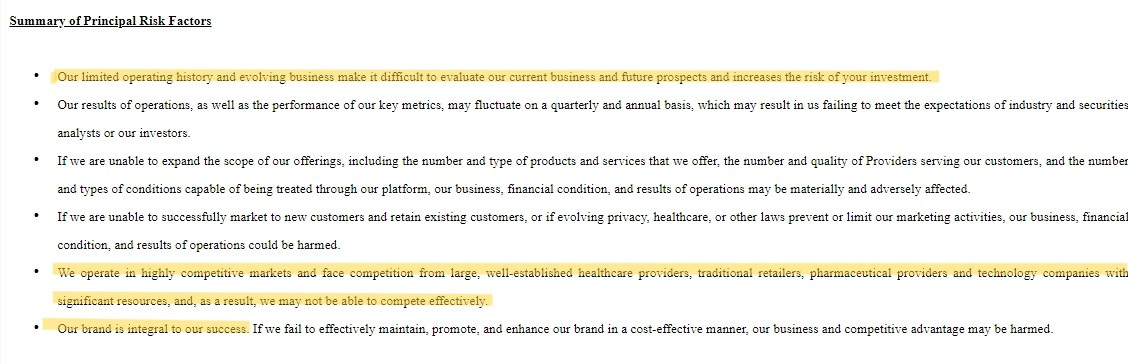

One way I like to try to find an answer is to search the 10-K for terms like “compete”, “advantage”, etc. Here’s what turned up.

We took prompt action to protect our employees’ health in response to the COVID-19 pandemic, including closing our offices in March 2020 and shifting to an official remote-first policy in June 2020. We have heavily invested in the software, tools, and culture that allow our company to be a leading force in the new remote-work environment. Not only has this allowed us to maintain and enhance our commitment to quality, our management team believes it has also provided a real competitive advantage by attracting diverse talent and garnering new geographic exposure. Because we prioritize hiring team members with a variety of lived experiences, we believe we get the benefit of more multi-faceted and nuanced insight into the customers we serve. This also ensures that our internal community reflects our vision for an equity-centered, inclusive workforce.

Uh…OK. I’m not seeing why customers would care where your employees work from or where they have lived, but sure.

While we believe there are currently no direct competitors that offer the full suite of solutions and direct-to-consumer touch points as we do, there are several companies that offer components of telehealth or address conditions that compete with our solutions.

This is the 2023 10-K, so perhaps they haven’t yet learned of the new upstart called “Amazon” who offer telehealth…

Treatment for ED and hair-loss:

And a pharmacy…

To be fair, Hims does sort of put this in the risks section of the 10-K:

Right here is where this goes into the “no” pile for me. Done. No more research necessary.

Why?

Because I don’t think there’s a moat here.

To me (mind you this is after 15 or 20 minutes spent on this) what you have is a marketing company that offers nothing unique.

In fact, they’re directly competing against Amazon - always a very bad idea.

Amazon can run their healthcare business unprofitably forever and subsidize it with earnings from AWS - the same way they run their retail business.

For the sake of the article let’s go on…

Let’s say you think that Amazon won’t crush Hims.

What is the market pricing this company at?

$3.6 billion.

Amazon, JPMorgan Chase, and Berkshire Hathaway reportedly invested around $3 billion in the Haven healthcare initiative. Remember, that’s the one that was going to disrupt healthcare and failed…

If you hired someone good, do you think you could build a competitor to Hims with $3.6 billion. I think you could.

If I gave you $700 billion, could you compete with Walmart? I would not take that challenge. I don’t think I could build the stores, distribution centers, logistics, supplier relations, etc. to compete with Walmart. That’s a moat.

So what’s all the excitement about?

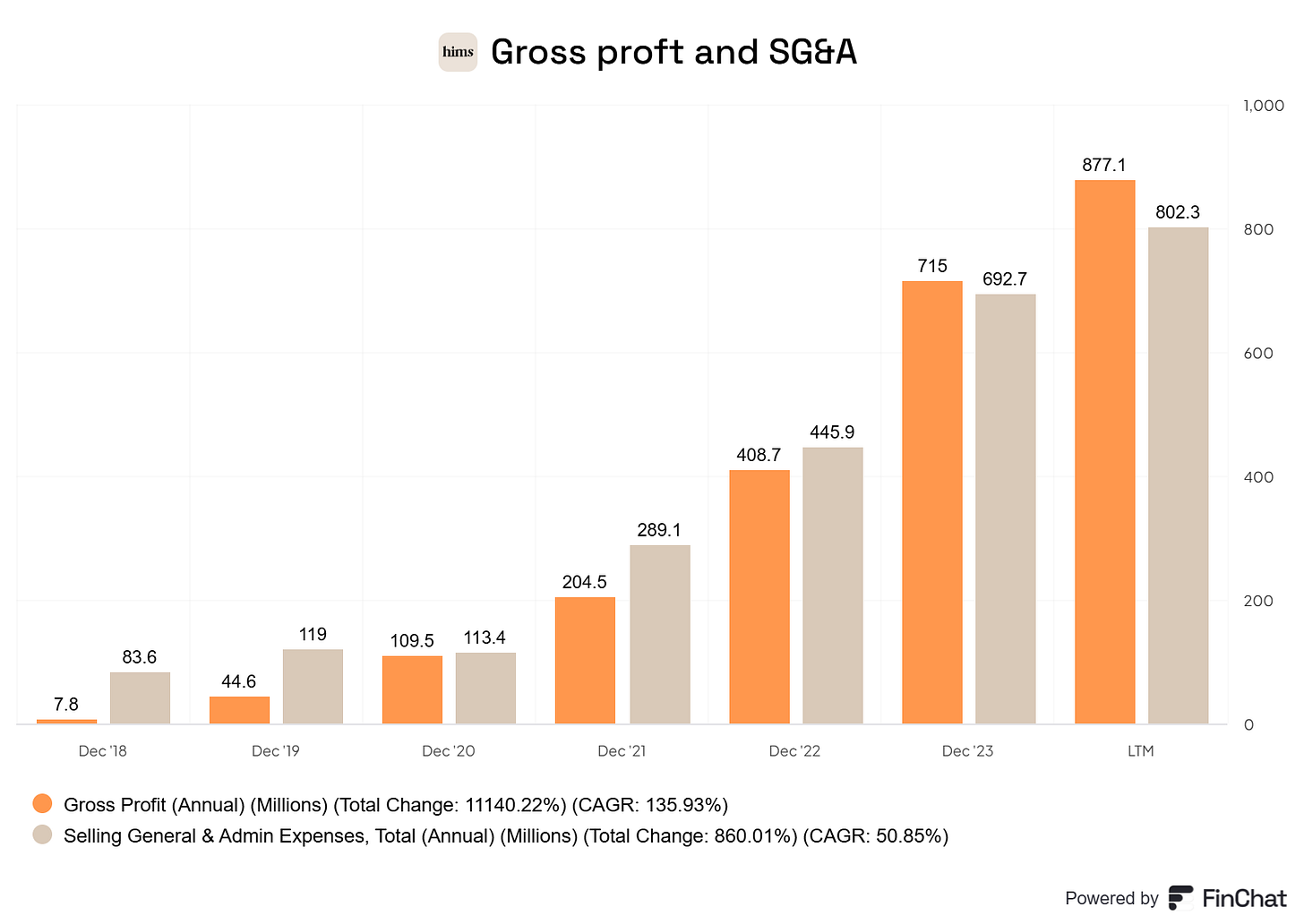

Growth. It’s impressive:

But remember, I suspected that this was a marketing company. A quick look at the financials and I think I might be right:

Almost all of the gross profit gets plowed back into selling more. Which might be OK if you’re trying to build traction for a unique product. But Hims is just branding generic medicine.

How about management?

I can already tell you that I don’t trust them based on the pieces of the 10-K I read. But I prefer to watch what they do more than what they say.

What they’re doing is diluting the heck out of shareholders.

This is pretty typical in a young company, but it’s not something I like. And it’s not something I’m going to get involved in if I don’t see a moat.

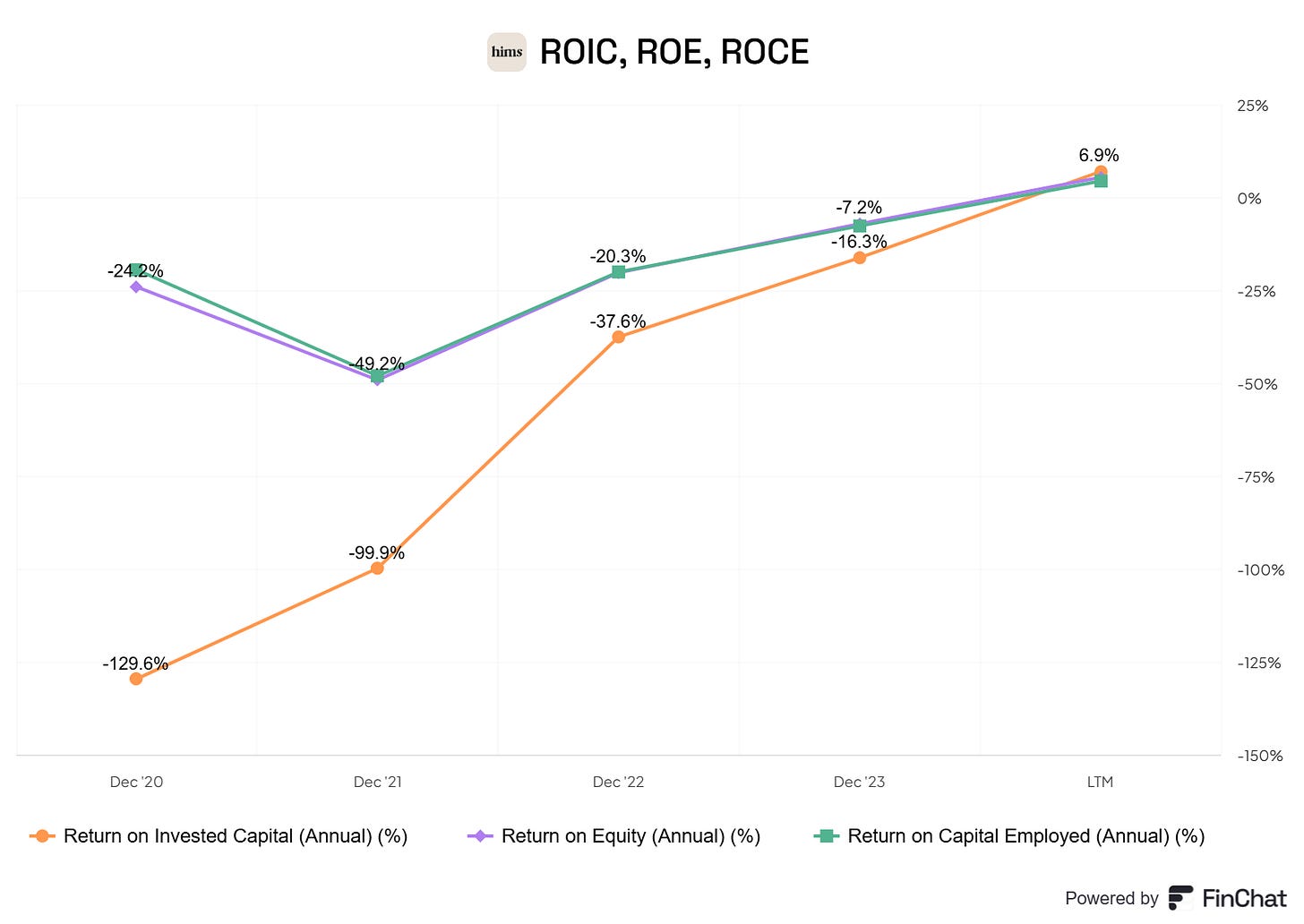

I will give them a bit of credit in the fact that the company isn’t drowning in debt and that the capital allocation numbers are improving.

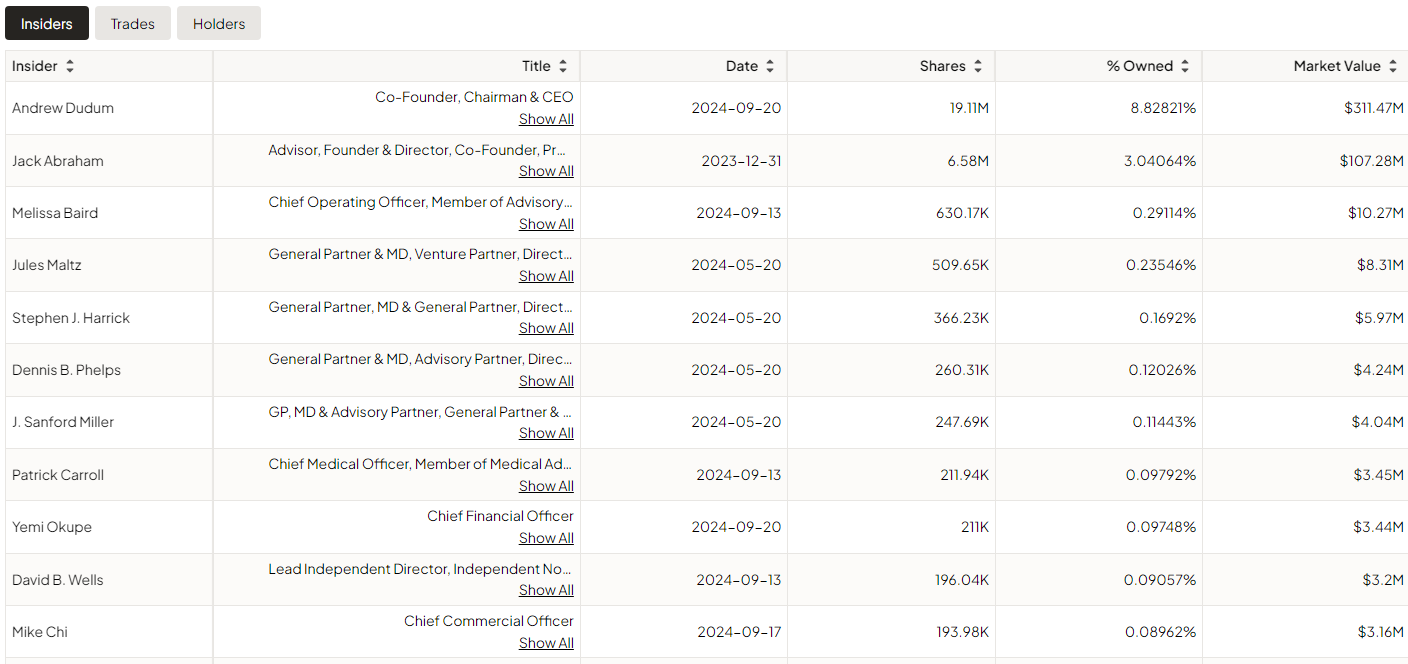

But I would like to see more ownership from them:

Just for fun, let’s try to value this thing.

The way I started is by looking for similar companies that are a little more mature. If I could find that, I could try to take a guess at a revenue growth rate, then apply a more mature comapny’s net margin to figure out profits.

The problem is that it’s really hard to find a profitable company that’s similar.

I checked out:

Amwell

GoodRX

1Life Healthcare (the company Amazon acquired that is the competitor in the screenshots)

Doximity

American Well Corp.

LifeMD

We can look at a price to sales multiple, but they’re all over the place for the competitors, and ultimately,x we don’t know what the profit margin for Hims will be so I’m not sure how useful that would be.

Here’s what I came up with:

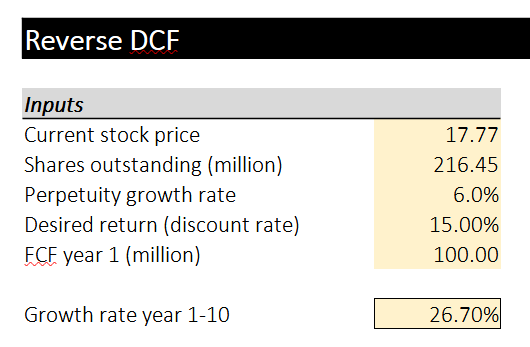

I ran a reverse DCF to see what the expectations embedded in the stock price were:

Because Hims is young, I bumped the perpetuity growth rate to 6%. So we’ve got $100 million in FCF expected to grow by about 27% per year for a decade.

That gives us about 4 doubles in 10 years, so $1.6 billion in FCF.

What’s that going to require in revenue? We can look at FCF margins to take a guess:

They center around 10% to 15% for comparable companies, with Teladoc the outlier at 34%.

Now we can see what the revenue has to be at those margins to get us to $1.6 billion in FCF:

10% margins = $16 billion

15% margins = $10.6 billion

30% margins = $5.3 billion

Can they get there? Maybe. Here are a few companies that are in that revenue range:

Cintas: $10 billion

Principal Financial: $15 billion

NVR: $10 billion

Cerner: $5.8 billion

Let’s look at some market stats. I just asked Google for these, and didn’t dig heavily in, so take them for what they are.

ED Medication Market

According to a market research study published by The Brainy Insights, the demand analysis of global erectile dysfunction drugs market size & share revenue was valued at around USD 3.0 billion in 2022 and is estimated to grow about USD 7.1 billion by 2032, at a CAGR of approximately 5.72%

Hair Loss Medication Market

Newly-released Alopecia Treatment Market analysis report by Future Market Insight shows that global sales of the Alopecia Treatment Market in 2021 were held at US$ 8.4 Billion. With a CAGR of 9.5% from 2022 to 2032, the market is projected to reach a valuation of US$ 22.5 Billion by 2032.

GLP-1 Market

The size of global GLP-1 analogues market in terms of revenue was estimated to be worth $47.4 billion in 2024 and is poised to reach $471.1 billion by 2032, growing at a CAGR of 32%.

So if Hims is going to grow that quickly, for that long, it’s likely to mostly be in the GLP-1 market, or they’re going to have to expand into other markets rather quickly.

Conclusion

I try to say no as quickly as possible. For Hims, it was as soon as I was unconvinced of the moat.

Using Daniel Kahneman’s idea of base rates, we can see that companies operating in a similar space have a hard time making money and that 3 of the largest, best run corporations couldn’t “disrupt” the American healthcare system.

The writing from management in the 10-K convinced me that they were very good salespeople, providing further proof of my suspicion that Hims is a really good marketing company.

Valuing a company like Hims is really tough, and normally I wouldn’t have even bothered, but to get a decent return, Hims has to grow their revenue to the size of Cintas, Cerner, or NVR. Based on the fact that they’re competing with Amazon and I don’t see a moat, I think this is unlikely.

I could, as always be wrong. This type of company isn’t one I normally would even look at, but hopefully seeing how I’d think about it was helpful.

It’s good to see a counter perspective. I am a big time bull on Hims. What I think you miss with the moat is that it’s a lollapalooza moat. Meaning, for such company to work, it has to do many things right, many things have to align and Hims has done that. You can justify how hard it is by actually looking at how Berkshire & Amazon failed. What I think you miss with expenses is that they are cash flow positive, they are not burning money. They are creating actual shareholder value. Plus, their market share among newcomers is higher than overall market share. When it comes to market opportunity, they haven’t entered into sleep & diabetes yet. This is $120 billion market opportunity. It can still fail, but I don’t think it’s on a place to be pessimist. But again, I respect your perspective and it’s good to see it. Congrats.

Hi TJ, every time I see one of their commercials it is a big no for me! Your article makes me feel justified in how I see this company!