After walking through how I rejected Hims:

I thought it might be interesting to walk through one way I sometimes work through lists of stocks.

They could come from a screener, the new 52-week low list, or an article.

Today’s list came from a Seeking Alpha article:

These stocks have high dividend growth + high free cash flow yield

The list has 43 names, so I put them into a Finchat dashboard and brought up some metrics to help me sort through them.

I exported the data to a spreadsheet just because it’s cleaner for me to look at, but you can do everything I’m about to do right in Finchat as well.

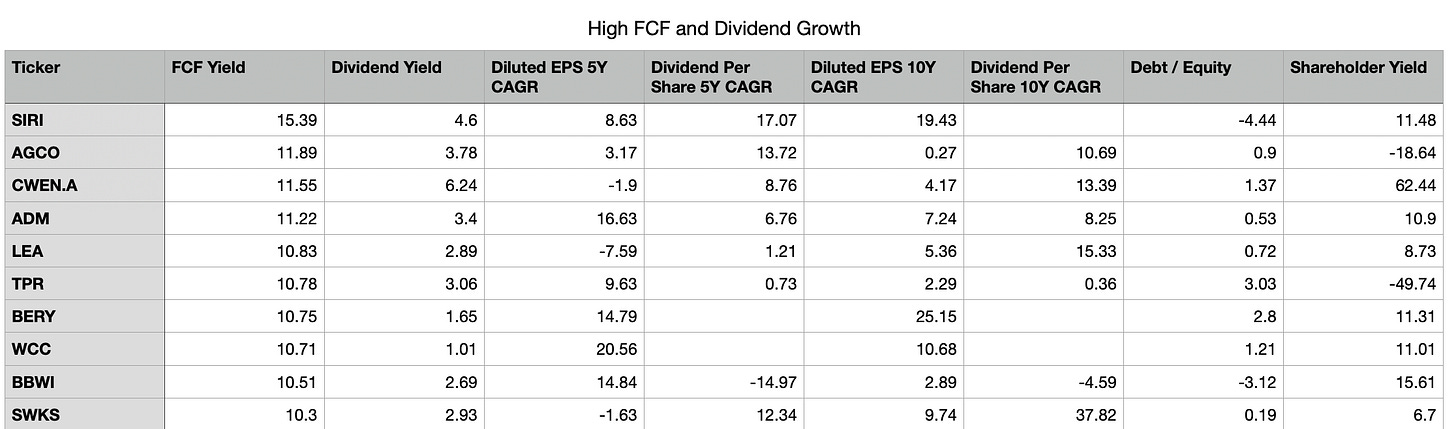

Here’s the data I put into the dashboard:

FCF Yield: Obviously an interesting metric since that’s part of the criteria on the list

Dividend Yield: Another interesting metric because these are likely Shareholder Yield type companies

5-Year and 10- Year EPS and DPS CAGR: We’re going to look at dividend growth, so I want to know that earnings are keeping up, having both numbers side by side makes this easy

Debt / Equity: This is a quick way to screen out anything with too much leverage

Shareholder Yield: I love that Finchat gives me this number. This is a more complete picture of how much capital is really being returned

Start Sorting

FCF Yield

I started by sorting the companies to show me which ones had the highest FCF Yields.

Sirius XM shows up at the top of the list. Buffett has been buying Sirius. It’s got good growth in EPS over 5 and 10 years, plus a shareholder yield over 10%. This one might be worth paying attention to.

Agco has almost no EPS growth over 10 years and a negative shareholder yield, pass.

Clearway (CWEN.A) has a mixed picture - negative 5-year EPS growth, positive 10-year growth, a higher debt to equity than I like, but the Shareholder yield is intriguing. We can probably do better though.

Archer-Daniels-Midland (ADM) looks interesting here. A nice FCF yield, Good DPS growth, a reasonable Debt / Equity and a nice Shareholder Yield number.

Debt / Equity

Let’s look for strong balance sheets by sorting low to high on Debt/Equity.

I pulled a few more companies in on this one. We have some negative debt / equity companies. Those require a little more research. Sometimes it means there’s a massive amount of debt on the books, or there’s been big asset write downs.

Sometimes it means that the company has been heavily buying back shares. You also see this in asset-light companies like franchise operators.

Wynn Resorts (WYNN) stands out as a pretty quick pass - negative Debt / Equity, negative EPS growth, no thanks.

McKesson (MCK) is showing good EPS growth, and reasonable dividend growth, plus a reasonable Shareholder Yield. It might be worth a look.

Lennar (LEN) and Pulte (PMH) have impressive EPS growth over 5 years and Lennar has done great over 10 years. The homebuilders should have tailwinds for years with housing shortages. They might be worth a look.

Reliance (RS) and Boise Cascade (BCC) both stand out with strong earnings growth, strong dividend growth, and conservative balance sheets. Reliance is a steel and metal product producer and Boise Cascade does engineered wood products and building materials. Both could be cyclical.

Shareholder Yield

Next, let’s sort by Shareholder Yield:

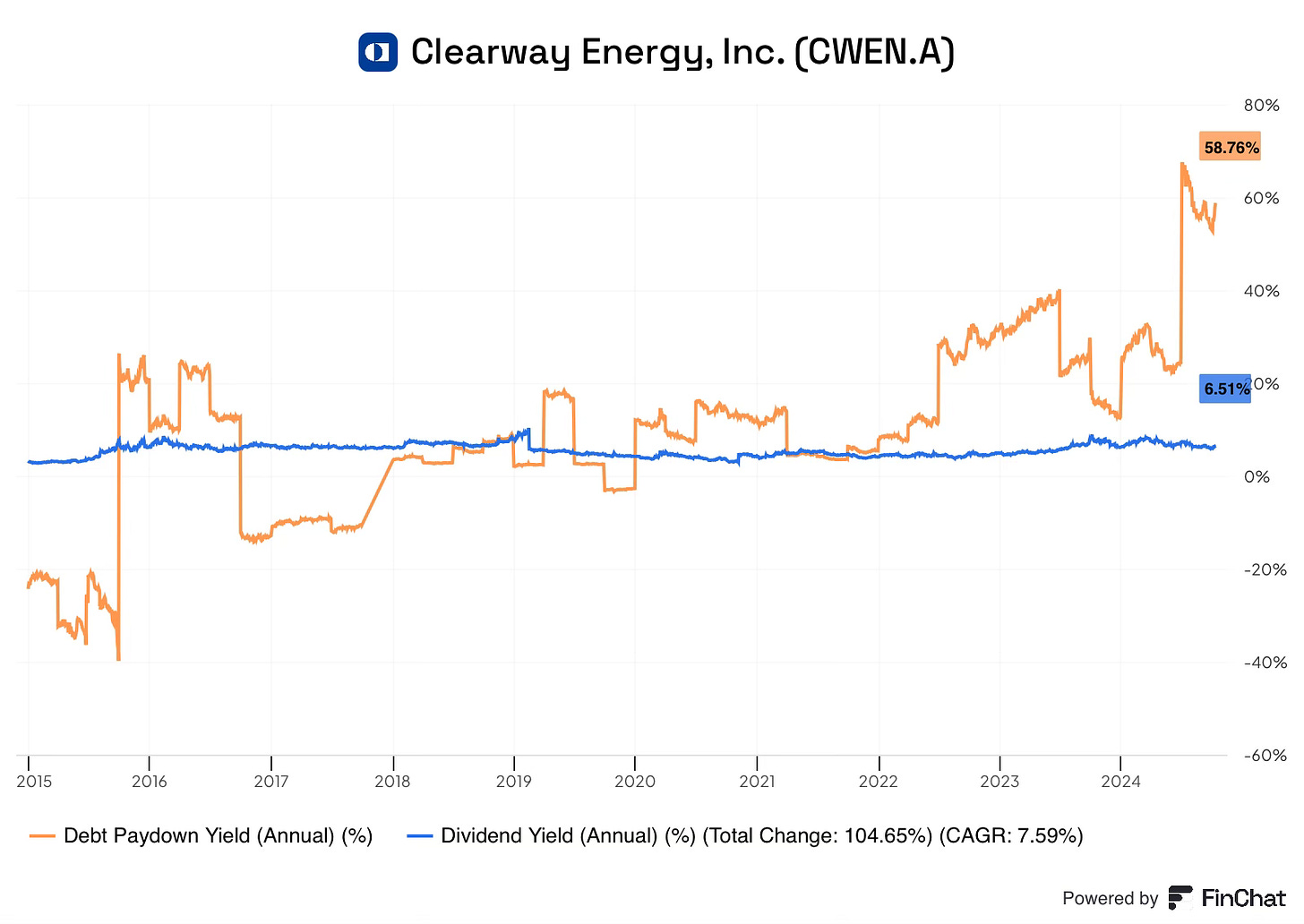

No surprise that Clearway shows up again with a 62% Shareholder Yield. Again, probably not sustainable, but worth a quick look at how they’re getting there.

Orange is Debt Paydown, Blue is Dividend Yield. They’ve paid back a lot of debt in the past year, boosting the Shareholder Yield.

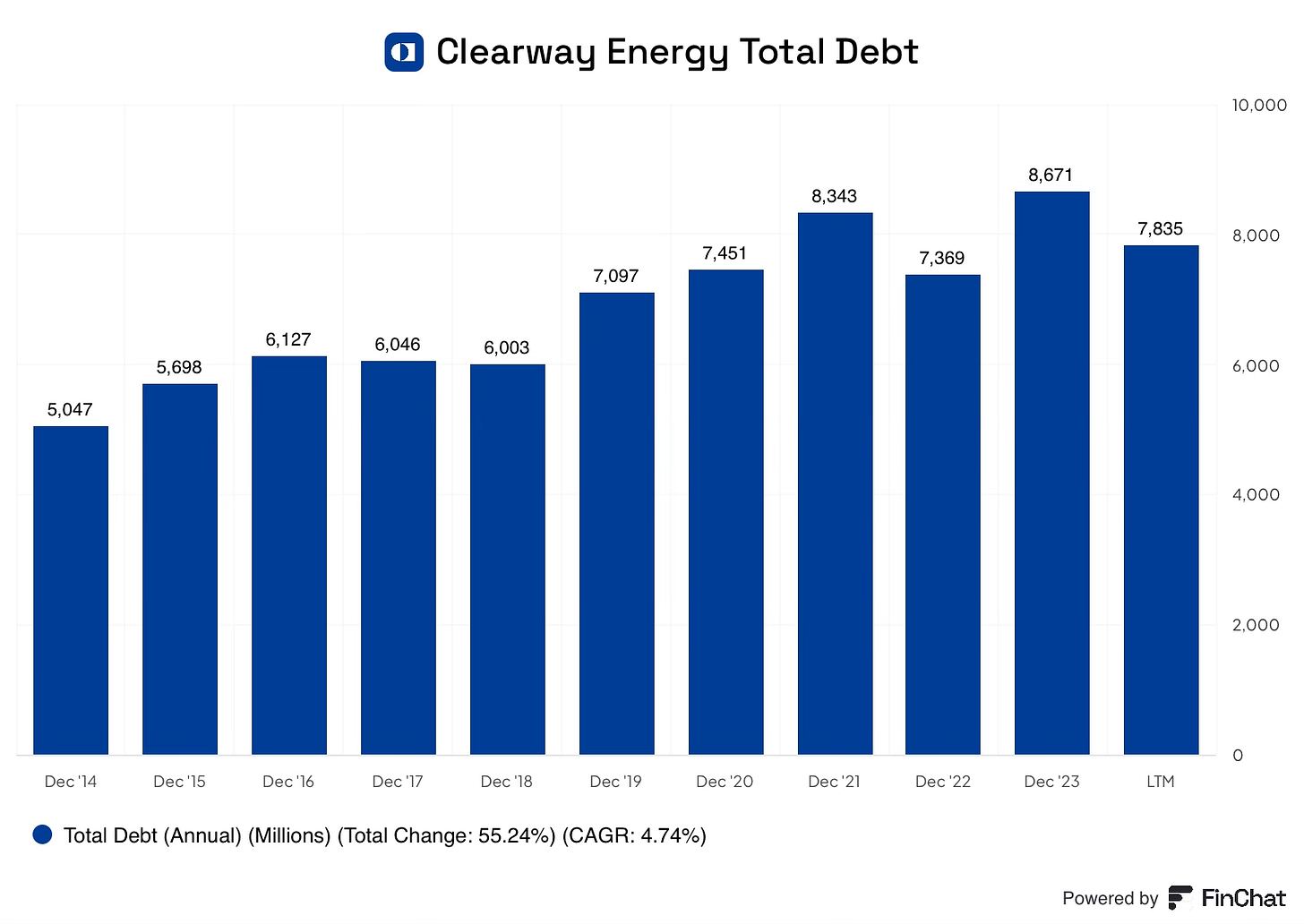

Here’s their total debt:

It looks like Clearway is targeting some level of debt, and pays it off when it gets too high. Given the low EPS growth, I’m going to say we can do better than Clearway.

Sirius XM shows up again, as does Boise Cascade, and Archer-Daniels-Midland.

10 - Year DPS Growth

One more sort. This one resulted in some crazy numbers at the top, like Cigna at over 160% - but that’s because Cigna has only paid a dividend since 2021.

Scrolling past the unrealistic stuff, we get to here:

Amdocs (DOX) looks OK, but DPS is growing faster than EPS.

Reliance shows up again, along with McKesson and Archer-Daniels-Midland

TE Connectivity (TEL) looks stable with a conservative balance sheet, and reasonable current dividend and shareholder yields.

EMCOR (EME) looks interesting as well, with a lot of growth in EPS, and high dividend growth. The current dividend and shareholder yields look low, but the balance sheet is conservative.

Another homebuilder also shows up in KB Home (KBH).

What Did We Find?

Out of 43 stocks, we’ve pretty quickly filtered it down to 9. We’ve eliminated 80% of an already filtered list. Not a bad use of time.

I’m sure there’s a great investment in this list that we didn’t find using this method, but the goal isn’t to find every great investment. It’s to find a few in the most efficient way possible.

There’s more to life than reading 10-Ks. Here’s how I’d rank what we have left:

Most interesting

These showed up multiple times. They’re all established companies, and Sirius XM has the Buffett seal of approval. The homebuilders all should have tailwinds for years.

Archer-Daniels-Midland

McKesson

Sirius XM

The homebuilders - KB Home, Pulte, Lennar

Next Tier

These also look interesting, but either have lower growth or potential cyclicality.

TE Connectivity

Reliance Systems

Boise Cascade

What do you think?

What are the most interesting companies from our filtered list?